Welcome to our article on education loans! Education loans are a valuable resource for students and families looking to fund higher education. In this article, we’ll take a closer look at what education loans are, why they are important, and everything you need to know about qualifying for and repaying them.

Whether you’re a current or future student, or a parent looking to support your child’s education, this guide will provide you with the information you need to make informed decisions about education loans. Let’s get started!

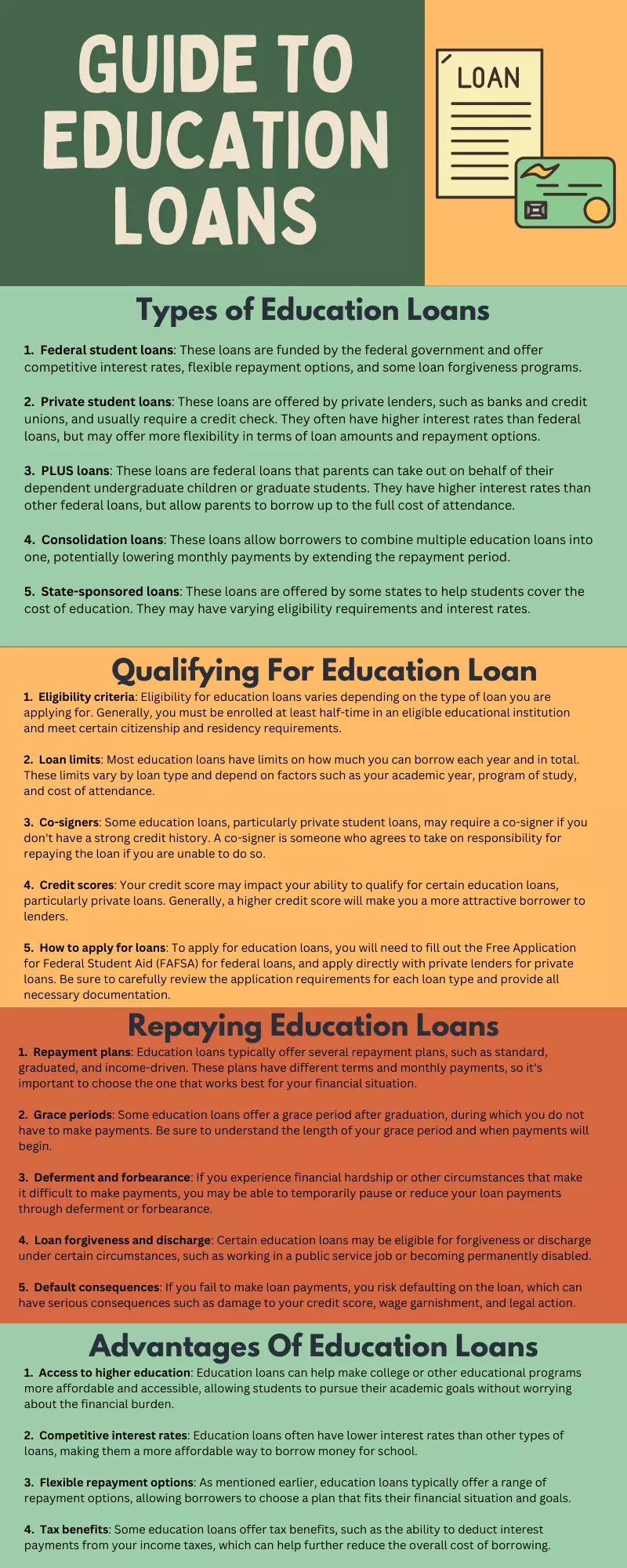

Types Of Education Loans

When it comes to education loans, there are several types to choose from. Understanding the differences between them is key to making the best decision for your unique situation. Here are the main types of education loans:

- Federal student loans: These loans are funded by the federal government and offer competitive interest rates, flexible repayment options, and some loan forgiveness programs.

- Private student loans: These loans are offered by private lenders, such as banks and credit unions, and usually require a credit check. They often have higher interest rates than federal loans, but may offer more flexibility in terms of loan amounts and repayment options.

- PLUS loans: These loans are federal loans that parents can take out on behalf of their dependent undergraduate children or graduate students. They have higher interest rates than other federal loans, but allow parents to borrow up to the full cost of attendance.

- Consolidation loans: These loans allow borrowers to combine multiple education loans into one, potentially lowering monthly payments by extending the repayment period.

- State-sponsored loans: These loans are offered by some states to help students cover the cost of education. They may have varying eligibility requirements and interest rates.

By understanding the differences between these types of education loans, you can make an informed decision about which one is right for you.

Qualifying For Education Loans

Qualifying for education loans can seem like a daunting task, but it doesn’t have to be. Here’s what you need to know:

- Eligibility criteria: Eligibility for education loans varies depending on the type of loan you are applying for. Generally, you must be enrolled at least half-time in an eligible educational institution and meet certain citizenship and residency requirements.

- Loan limits: Most education loans have limits on how much you can borrow each year and in total. These limits vary by loan type and depend on factors such as your academic year, program of study, and cost of attendance.

- Co-signers: Some education loans, particularly private student loans, may require a co-signer if you don’t have a strong credit history. A co-signer is someone who agrees to take on responsibility for repaying the loan if you are unable to do so.

- Credit scores: Your credit score may impact your ability to qualify for certain education loans, particularly private loans. Generally, a higher credit score will make you a more attractive borrower to lenders.

- How to apply for loans: To apply for education loans, you will need to fill out the Free Application for Federal Student Aid (FAFSA) for federal loans, and apply directly with private lenders for private loans. Be sure to carefully review the application requirements for each loan type and provide all necessary documentation.

By understanding the qualifying criteria and application process for education loans, you can maximize your chances of being approved for the loan that best meets your needs.

Repaying Education Loans

Repaying education loans is an important part of the loan process. Here are the key things you need to know:

- Repayment plans: Education loans typically offer several repayment plans, such as standard, graduated, and income-driven. These plans have different terms and monthly payments, so it’s important to choose the one that works best for your financial situation.

- Grace periods: Some education loans offer a grace period after graduation, during which you do not have to make payments. Be sure to understand the length of your grace period and when payments will begin.

- Deferment and forbearance: If you experience financial hardship or other circumstances that make it difficult to make payments, you may be able to temporarily pause or reduce your loan payments through deferment or forbearance.

- Loan forgiveness and discharge: Certain education loans may be eligible for forgiveness or discharge under certain circumstances, such as working in a public service job or becoming permanently disabled.

- Default consequences: If you fail to make loan payments, you risk defaulting on the loan, which can have serious consequences such as damage to your credit score, wage garnishment, and legal action.

By understanding the repayment options and consequences of education loans, you can make a plan to responsibly repay your loans and avoid default.

Advantages Of Education Loans

Education loans offer a number of advantages that can help make higher education more accessible and affordable. Here are some key benefits:

- Access to higher education: Education loans can help make college or other educational programs more affordable and accessible, allowing students to pursue their academic goals without worrying about the financial burden.

- Competitive interest rates: Education loans often have lower interest rates than other types of loans, making them a more affordable way to borrow money for school.

- Flexible repayment options: As mentioned earlier, education loans typically offer a range of repayment options, allowing borrowers to choose a plan that fits their financial situation and goals.

- Tax benefits: Some education loans offer tax benefits, such as the ability to deduct interest payments from your income taxes, which can help further reduce the overall cost of borrowing.

By taking advantage of the benefits of education loans, you can make higher education more affordable and attainable, helping you achieve your academic and career goals.

FAQs

Here are some frequently asked questions about education loans:

1. What is the difference between federal and private student loans?

Federal student loans are funded by the government and often have more favorable terms, such as fixed interest rates and flexible repayment options. Private student loans are offered by banks, credit unions, and other lenders and may have variable interest rates and stricter repayment terms.

2. What is the interest rate on education loans?

Interest rates on education loans vary depending on the type of loan, the lender, and other factors. Federal student loan interest rates are set by the government and are generally lower than private student loan rates. Private student loan rates can vary widely based on the borrower’s credit score, the lender, and other factors.

3. How do I apply for an education loan?

To apply for an education loan, you typically need to complete an application and provide information about your income, credit history, and other financial details. You can apply for federal student loans by filling out the Free Application for Federal Student Aid (FAFSA). Private student loans usually require a separate application.

4. Can I use an education loan for non-tuition expenses?

Yes, education loans can be used to cover a range of education-related expenses, including tuition, room and board, textbooks, and other supplies.

5. Can I refinance my education loans?

Yes, it may be possible to refinance your education loans to get a lower interest rate, change your repayment terms, or consolidate multiple loans into one. However, refinancing is typically only available for private student loans, not federal student loans.

6. What are the eligibility requirements for federal student loans?

To be eligible for federal student loans, you must be a U.S. citizen or eligible noncitizen, enrolled in an eligible degree or certificate program, and maintain satisfactory academic progress. You also cannot have any prior student loan defaults or owe an overpayment on a federal grant.

7. How do I calculate how much student loan I need?

To calculate how much student loan you need, you should first determine your total cost of attendance, including tuition, fees, room and board, and other expenses. Then, subtract any grants, scholarships, or other forms of financial aid you have received. The remaining amount is the maximum amount you can borrow in student loans.

8. How long does it take to pay off an education loan?

The length of time it takes to pay off an education loan depends on the type of loan, the amount borrowed, and the repayment plan you choose. Standard repayment plans for federal student loans typically require payments over 10 years, but you can choose longer repayment periods with some plans. Private student loans may have shorter or longer repayment periods, depending on the lender.

9. Can I get an education loan without a co-signer?

It is possible to get an education loan without a co-signer, but it may be more difficult if you have limited credit history or income. Federal student loans do not require a co-signer, but private student loans often do.

10. What happens if I default on my education loan?

If you default on your education loan, the lender or loan servicer can take legal action to collect the debt, such as wage garnishment, tax refund seizure, or even legal action. Defaulting can also damage your credit score and make it more difficult to obtain credit in the future. It’s important to communicate with your lender or servicer if you’re having trouble making payments to avoid defaulting.

By understanding the answers to these common questions, you can make informed decisions about borrowing for education and managing your education loans responsibly.

Conclusion

In conclusion, education loans play a vital role in helping students achieve their academic and career goals. Whether you’re pursuing an undergraduate or graduate degree, there are various types of education loans available, including federal and private loans, PLUS loans, and state-sponsored loans.

To qualify for an education loan, you need to meet certain eligibility criteria, including loan limits, co-signers, and credit scores. Repaying education loans can be challenging, but there are several repayment plans, grace periods, deferment and forbearance options, and loan forgiveness programs available.

Overall, education loans offer many advantages, including access to higher education, competitive interest rates, flexible repayment options, and tax benefits. So, if you’re considering pursuing higher education, be sure to explore your education loan options and choose the one that’s right for you.