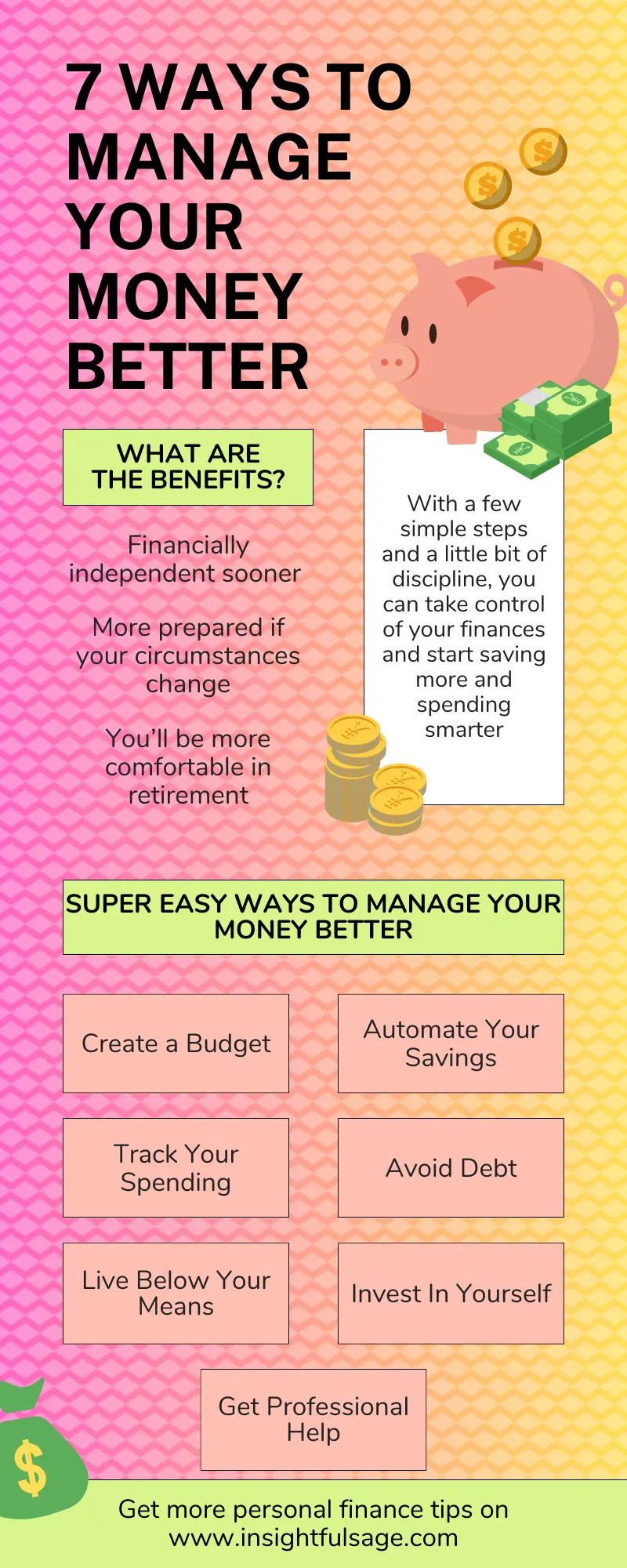

Money management can feel overwhelming, but don’t worry, it’s actually a lot easier than you might think. With a few simple steps and a little bit of discipline, you can take control of your finances and start saving more and spending smarter. Whether you’re just starting out or you’ve been managing your money for years, there’s always room for improvement.

In this journey to better money management, it’s important to remember that everyone’s financial situation is unique. What works for one person may not work for another. However, by understanding the basics of budgeting, savings, and debt management, you’ll have the tools you need to create a personalized plan that works for you. With a little bit of effort and determination, you’ll be on your way to a brighter financial future in no time. So let’s get started!

Create A Budget

Creating a budget is the first step to taking control of your finances and making sure you’re spending and saving in a way that works for you. A budget is simply a plan for how you want to allocate your income each month.

By writing down all of your income and expenses, you’ll get a clear picture of where your money is going and where you can make changes to save more and spend smarter. It might seem like a hassle at first, but trust me, it’s worth it.

Having a budget will give you peace of mind and help you reach your financial goals faster. So grab a pen and paper, or open up a spreadsheet, and get started! I’ve already dedicated a post on how you can create a budget in a quick and easy way. Be sure to check it out and implement the steps before moving forward.

Automate Your Savings

Automating your savings is a game-changer when it comes to managing your money. It’s like a secret weapon that helps you save without even thinking about it. Here’s how it works: you set up a monthly transfer from your checking account to your savings account, and voila! Your savings are automatically growing without any effort on your part.

But why bother with automating your savings in the first place? Well, for starters, it’s way too easy to spend all the money you have in your checking account without even realizing it. By automatically transferring a portion of your income to your savings account each month, you ensure that you’re consistently putting money aside for your future.

Plus, automating your savings makes it easier to stick to your budget. When you see the money leaving your checking account each month, it’s a reminder of your commitment to saving. And the best part is, you won’t even feel it! You won’t miss the money because you never had it in your hands in the first place.

So if you’re looking for a simple, effective way to start saving more, give automating your savings a try. You’ll be amazed at how quickly your savings account grows.

Track Your Spending

Tracking your spending is a crucial part of managing your money, but it’s often the step that people skip. It might seem like a hassle to keep track of every single purchase, but it’s actually much easier than you think, and the benefits are well worth the effort.

By tracking your spending, you’ll get a clear picture of where your money is going each month. You’ll see how much you’re spending on necessities like rent and food, and how much you’re spending on things like entertainment and shopping. This information will help you make informed decisions about your spending and figure out where you can cut back to save more.

There are a few different ways to track your spending, so find the method that works best for you. Some people like to use a budgeting app, while others prefer to write everything down in a notebook. No matter which method you choose, the important thing is to be consistent and update your records every day.

Tracking your spending can also help you identify any bad spending habits and make changes to improve your finances. So don’t be afraid to get started! A little bit of effort and discipline can go a long way in helping you reach your financial goals.

Avoid Debt

Avoiding debt requires discipline and planning, but it’s definitely worth the effort. Another key strategy is to pay off credit card balances in full each month. The interest on credit card debt can quickly add up, and before you know it, you could be in over your head. By paying off your balance in full each month, you’ll avoid interest charges and keep your debt under control.

Another effective way to avoid debt is to make a budget and stick to it. By tracking your spending and making a plan for how you want to allocate your money each month, you’ll be less likely to overspend and get into debt. A budget can also help you prioritize your spending, so you can make sure you’re spending money on the things that are most important to you.

Avoiding debt requires effort and discipline, but the benefits are well worth it. By making a budget, paying off credit card balances in full, and sticking to a plan, you’ll be well on your way to a debt-free future.

Invest In Yourself

Investing in yourself is one of the best things you can do for your financial future. Not only will it help you reach your goals and improve your quality of life, but it can also pay off in the long run in the form of career advancement, higher earnings, and personal growth.

One way to invest in yourself is to continue learning and developing new skills. This can be through formal education, like taking a course or getting a degree, or through more informal means like reading books, attending workshops, or learning online. By continually growing your knowledge and skills, you’ll be better equipped to succeed in your career and earn more money over time.

Another way to invest in yourself is to take care of your health. This includes regular exercise, eating a healthy diet, and getting enough sleep. By taking care of your physical and mental well-being, you’ll be able to perform at your best and enjoy a higher quality of life.

Finally, investing in yourself can also mean taking the time to pursue your passions and hobbies. Whether it’s learning a new language, taking up photography, or volunteering in your community, these activities can bring you joy, fulfillment, and a sense of purpose.

Investing in yourself is a smart financial move that can pay off in many ways. Whether it’s through education, health, or personal growth, the benefits of investing in yourself are long-lasting and well worth the effort.

Live Below Your Means

Living below your means is one of the key strategies for managing your money effectively. Simply put, it means spending less than you earn, and avoiding the temptation to live beyond your means.

The first step in living below your means is to get a handle on your spending. This means tracking your expenses, so you know exactly where your money is going each month. Once you have a clear picture of your spending habits, you can start to make changes and cut back on unnecessary expenses.

Another important aspect of living below your means is to set financial goals. I’ve created a downloadable list you can use for setting financial goals. This can be saving for a down payment on a house, paying off debt, or building up your emergency fund. By having specific goals in mind, you’ll be motivated to stick to your budget and avoid overspending.

It’s also important to be mindful of your spending and make conscious choices about where your money goes. This means being selective about what you buy and avoiding impulse purchases. Instead, focus on buying the things you need and want, and make smart choices that align with your financial goals.

Living below your means is all about spending wisely and avoiding debt. By tracking your expenses, setting financial goals, and making conscious spending choices, you’ll be well on your way to a healthier financial future.

Get Professional Help

Getting professional help can be a smart move when it comes to managing your money. Whether you’re struggling with debt, trying to save for retirement, or simply want to get a better handle on your finances, a professional financial advisor can provide valuable guidance and support.

One of the biggest benefits of working with a financial advisor is that they can help you create a customized financial plan that’s tailored to your specific needs and goals. They can help you assess your current financial situation, identify areas where you can improve, and develop a strategy for reaching your financial goals.

Another advantage of working with a financial advisor is that they can help you stay on track and make sure you’re making progress towards your goals. They can provide regular check-ins, help you stay focused and motivated, and make adjustments to your plan as needed.

It’s also worth noting that financial advisors can offer expertise and insights that you might not be able to get on your own. They have years of experience and training, and can provide advice on everything from investments to taxes to insurance.

Getting professional help can be a smart move when it comes to managing your money. Whether you’re struggling with debt, trying to save for retirement, or simply want to get a better handle on your finances, a financial advisor can provide valuable guidance and support.

Summary

In conclusion, there are many effective ways to manage your money, and the key is to find the strategies that work best for you. Whether you choose to create a budget, automate your savings, or work with a professional financial advisor, the important thing is to get started and make a plan.

Remember, managing your money is a journey, and it’s important to be patient and persistent. It’s also important to stay focused on your financial goals and avoid overspending or taking on too much debt. By making smart choices and staying disciplined, you can build a strong financial foundation and achieve financial stability and security.

Ultimately, managing your money is about taking control of your financial future and ensuring that you have the resources you need to achieve your goals and live the life you want. With the right tools and strategies, you can become a savvy money manager and secure your financial future.