Welcome to our guide on Understanding Your Disability Insurance. In this guide, we’ll be discussing the ins and outs of disability insurance, so you can have a better understanding of how it works, and what it can do for you.

Disability insurance is a type of insurance policy that helps protect your income if you become unable to work due to a disability. It provides financial support to cover your living expenses and other expenses that you may incur due to your disability, such as medical bills and rehabilitation costs.

A disability can be defined as any physical or mental condition that prevents you from performing your job duties. This can range from a physical injury, such as a back injury, to a mental health condition, such as depression or anxiety. Disability insurance can help provide peace of mind knowing that you’ll have financial support if you’re unable to work due to a disability.

In this guide, we’ll cover the different types of disability insurance, how to determine your coverage needs, what to look for in a disability insurance policy, and how to file a claim. Whether you’re considering purchasing disability insurance for the first time or you already have a policy and want to understand it better, this guide will provide you with the knowledge and tools to make informed decisions about your coverage.

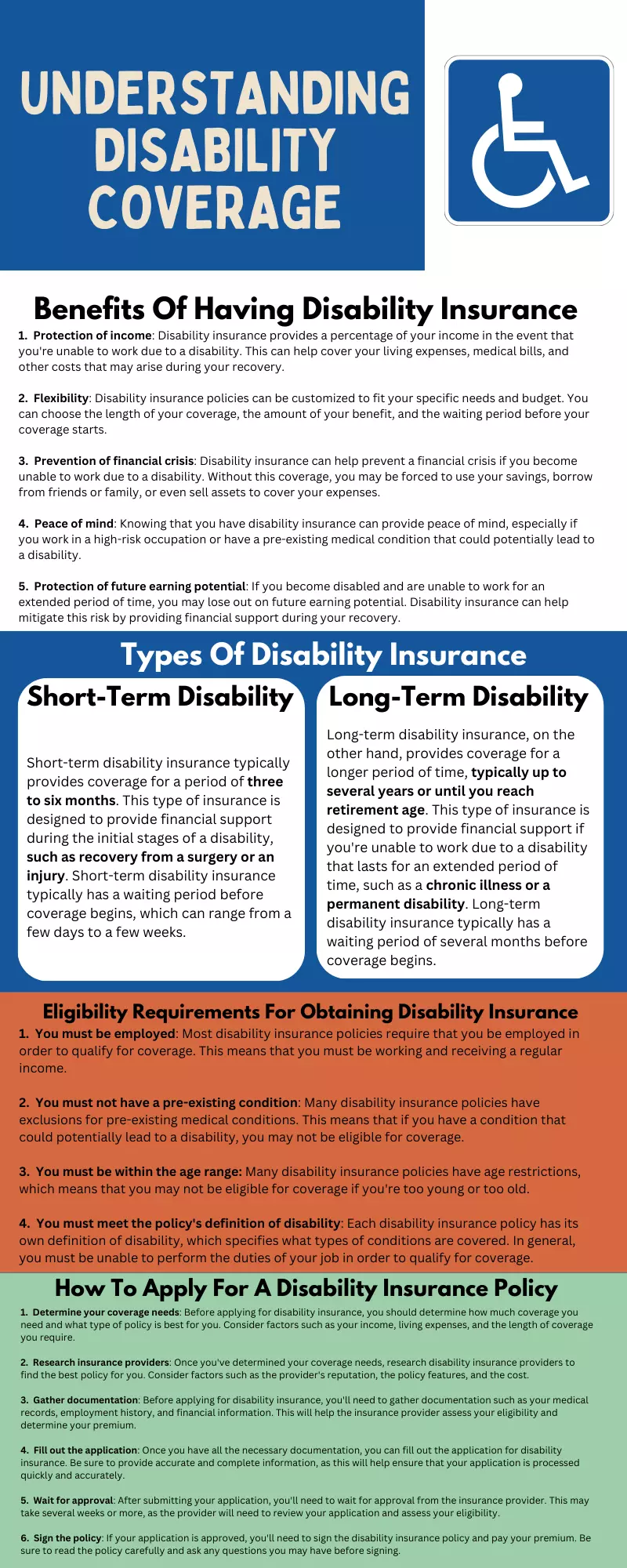

Benefits Of Having Disability Insurance

Having disability insurance can provide a wide range of benefits, including financial security and peace of mind. Here are some of the main benefits of having disability insurance:

- Protection of income: Disability insurance provides a percentage of your income in the event that you’re unable to work due to a disability. This can help cover your living expenses, medical bills, and other costs that may arise during your recovery.

- Flexibility: Disability insurance policies can be customized to fit your specific needs and budget. You can choose the length of your coverage, the amount of your benefit, and the waiting period before your coverage starts.

- Prevention of financial crisis: Disability insurance can help prevent a financial crisis if you become unable to work due to a disability. Without this coverage, you may be forced to use your savings, borrow from friends or family, or even sell assets to cover your expenses.

- Peace of mind: Knowing that you have disability insurance can provide peace of mind, especially if you work in a high-risk occupation or have a pre-existing medical condition that could potentially lead to a disability.

- Protection of future earning potential: If you become disabled and are unable to work for an extended period of time, you may lose out on future earning potential. Disability insurance can help mitigate this risk by providing financial support during your recovery.

Overall, disability insurance is an important form of protection for anyone who relies on their income to cover their living expenses. It can provide financial security and peace of mind, and help ensure that you’re able to focus on your recovery without having to worry about the financial impact of a disability.

Types Of Disability Insurance

Disability insurance is designed to provide financial support in the event that you’re unable to work due to a disability. There are two main types of disability insurance: short-term disability and long-term disability. Each type of insurance has its own unique features and benefits, so it’s important to understand the differences between them.

Short-Term Disability

Short-term disability insurance typically provides coverage for a period of three to six months. This type of insurance is designed to provide financial support during the initial stages of a disability, such as recovery from a surgery or an injury. Short-term disability insurance typically has a waiting period before coverage begins, which can range from a few days to a few weeks.

Long-Term Disability

Long-term disability insurance, on the other hand, provides coverage for a longer period of time, typically up to several years or until you reach retirement age. This type of insurance is designed to provide financial support if you’re unable to work due to a disability that lasts for an extended period of time, such as a chronic illness or a permanent disability. Long-term disability insurance typically has a waiting period of several months before coverage begins.

Both short-term and long-term disability insurance policies have their own unique features and benefits, so it’s important to carefully consider your needs and budget when choosing a policy. Short-term disability insurance is generally less expensive than long-term disability insurance, but it also provides coverage for a shorter period of time. Long-term disability insurance provides more comprehensive coverage, but it may be more expensive.

Short-term disability insurance is designed to provide financial support during the initial stages of a disability, while long-term disability insurance provides coverage for a longer period of time. Understanding the differences between these types of disability insurance can help you choose the right policy to meet your needs and budget.

Eligibility Requirements For Obtaining Disability Insurance

Disability insurance is an important form of protection that can provide financial support in the event that you become unable to work due to a disability. However, not everyone is eligible for disability insurance, and there are certain requirements that you must meet in order to qualify for coverage.

The eligibility requirements for disability insurance vary depending on the type of policy and the insurance provider. In general, however, most disability insurance policies require that you meet the following criteria:

- You must be employed: Most disability insurance policies require that you be employed in order to qualify for coverage. This means that you must be working and receiving a regular income.

- You must not have a pre-existing condition: Many disability insurance policies have exclusions for pre-existing medical conditions. This means that if you have a condition that could potentially lead to a disability, you may not be eligible for coverage.

- You must be within the age range: Many disability insurance policies have age restrictions, which means that you may not be eligible for coverage if you’re too young or too old.

- You must meet the policy’s definition of disability: Each disability insurance policy has its own definition of disability, which specifies what types of conditions are covered. In general, you must be unable to perform the duties of your job in order to qualify for coverage.

In order to be eligible for disability insurance, you must be employed, meet the policy’s definition of disability, not have a pre-existing condition, and meet any age restrictions that may apply. It’s important to carefully review the eligibility requirements of each policy before applying to ensure that you meet the necessary criteria.

How To Apply For A Disability Insurance Policy

If you’ve decided that disability insurance is right for you, the next step is to apply for a policy. Here are the steps you should follow to apply for disability insurance:

- Determine your coverage needs: Before applying for disability insurance, you should determine how much coverage you need and what type of policy is best for you. Consider factors such as your income, living expenses, and the length of coverage you require.

- Research insurance providers: Once you’ve determined your coverage needs, research disability insurance providers to find the best policy for you. Consider factors such as the provider’s reputation, the policy features, and the cost.

- Gather documentation: Before applying for disability insurance, you’ll need to gather documentation such as your medical records, employment history, and financial information. This will help the insurance provider assess your eligibility and determine your premium.

- Fill out the application: Once you have all the necessary documentation, you can fill out the application for disability insurance. Be sure to provide accurate and complete information, as this will help ensure that your application is processed quickly and accurately.

- Wait for approval: After submitting your application, you’ll need to wait for approval from the insurance provider. This may take several weeks or more, as the provider will need to review your application and assess your eligibility.

- Sign the policy: If your application is approved, you’ll need to sign the disability insurance policy and pay your premium. Be sure to read the policy carefully and ask any questions you may have before signing.

Applying for disability insurance involves determining your coverage needs, researching providers, gathering documentation, filling out the application, waiting for approval, and signing the policy. By following these steps, you can ensure that you get the coverage you need to protect yourself and your family in the event of a disability.

Cost And Coverage Considerations When Evaluating A Policy

When it comes to evaluating disability insurance policies, there are a few key factors to consider, including cost and coverage. Here’s what you should keep in mind:

- Cost: Disability insurance premiums can vary widely depending on the provider, the type of policy, and the level of coverage. In general, policies with more extensive coverage and longer benefit periods will have higher premiums. Before choosing a policy, it’s important to evaluate the cost and ensure that it fits within your budget.

- Coverage: Another important consideration when evaluating a disability insurance policy is the level of coverage it provides. This includes factors such as the benefit amount, the length of coverage, and the conditions that are covered. Make sure that the policy provides enough coverage to meet your needs and that it covers the types of disabilities that you’re most concerned about.

- Exclusions: It’s also important to carefully review any exclusions that may be included in the policy. Exclusions may limit coverage for certain types of disabilities or may exclude coverage for pre-existing conditions. Make sure that you understand the exclusions and how they may affect your coverage.

- Waiting periods: Many disability insurance policies have waiting periods before benefits are paid out. This means that you may need to rely on savings or other sources of income during this time. Be sure to factor in the waiting period when evaluating the policy’s coverage and cost.

- Riders: Finally, consider any optional riders that may be available with the policy. Riders can provide additional coverage for specific types of disabilities, or may offer benefits such as cost-of-living adjustments. However, riders can also increase the cost of the policy, so be sure to evaluate them carefully.

Evaluating a disability insurance policy requires careful consideration of factors such as cost, coverage, exclusions, waiting periods, and riders. By taking the time to evaluate these factors, you can choose a policy that provides the coverage you need at a price you can afford.

Common Questions About Disability Insurance Policies

If you’re considering purchasing a disability insurance policy, you may have some questions about how it works and what it covers. Here are some common questions about disability insurance policies:

- What is disability insurance? Disability insurance is a type of insurance that provides income replacement if you become disabled and are unable to work.

- What types of disabilities are covered? Disability insurance policies can cover a wide range of disabilities, including physical injuries, illnesses, and mental health conditions.

- How much coverage do I need? The amount of coverage you need will depend on your income, living expenses, and other financial obligations. A good rule of thumb is to aim for coverage that replaces at least 60% of your income.

- What is the difference between short-term and long-term disability insurance? Short-term disability insurance typically provides coverage for a few months up to a year, while long-term disability insurance can provide coverage for several years or even until retirement age.

- What is an elimination period? An elimination period is the amount of time you must wait before your disability insurance benefits kick in. This period can range from a few days to several months.

- Are pre-existing conditions covered? This will depend on the policy. Some policies may exclude coverage for pre-existing conditions, while others may provide coverage after a waiting period.

- How much does disability insurance cost? The cost of disability insurance will vary depending on factors such as your age, health, occupation, and the level of coverage you require.

Disability insurance can provide valuable protection if you become disabled and are unable to work. By understanding how disability insurance works and what it covers, you can make an informed decision about whether it’s right for you.

Conclusion

In conclusion, understanding your disability insurance policy is crucial to ensuring that you have the right level of coverage and protection in the event that you become disabled and are unable to work.

By knowing what your policy covers, how much coverage you need, and what your obligations are, you can make sure that you’re prepared for any eventuality. Whether you’re just starting out in your career or are nearing retirement age, disability insurance can provide peace of mind and financial security for you and your family.

So take the time to evaluate your options, ask questions, and choose a policy that meets your needs and budget.