Have you ever wondered how the tax system in the United States works? It can be confusing to navigate, especially when it comes to understanding tax brackets. But don’t worry, I’m here to help!

In this article, we’ll dive into the world of tax brackets and break down how they work in a simple and easy-to-understand way.

At its core, the tax system is designed to be progressive, which means that the more money you make, the more taxes you will pay.

Tax brackets are the mechanism by which this is accomplished. They determine the tax rate that you will pay on your income, based on your taxable income.

Understanding your tax bracket is crucial, as it can help you make informed decisions about your finances.

For example, if you are close to the threshold of a higher tax bracket, you may want to consider strategies to reduce your taxable income.

In this article, we’ll explore the ins and outs of tax brackets and help you understand how they impact your taxes. We’ll explain the different tax rates for each bracket, show you how to calculate your tax liability, and provide tips for minimizing your tax bill.

By the end of this article, you’ll be well on your way to becoming a tax bracket expert!

Learn these 3 strategies on how to lower your debt quickly.

Understanding Your Tax Bracket

Tax brackets can seem confusing at first, but they’re actually a relatively simple concept to understand. Put simply, they determine the rate at which you are taxed on your income.

Let’s say, for example, that you earn $50,000 a year. Your tax rate will be determined by the tax bracket you fall into, based on your taxable income. If your taxable income is less than $9,950, you will fall into the 10% tax bracket, which means you will pay 10% of your income in taxes.

The portion of your income that falls between $9,951 and $40,525 will be taxed at a rate of 12%, and the portion of your income that falls between $40,526 and $50,000 will be taxed at a rate of 22%.

While it might seem unfair that higher earners pay a higher percentage of their income in taxes, it’s important to note that the tax system is designed this way to promote social and economic equality.

In other words, the goal is to ensure that everyone pays their fair share of taxes based on their ability to pay. By having higher earners pay a higher percentage of their income in taxes, the tax system can provide important services and benefits to those who need them the most.

How Tax Brackets Work

When you file your taxes, the government calculates your tax liability based on your taxable income. Your taxable income is calculated by subtracting deductions and exemptions from your gross income.

Once your taxable income is determined, it is then matched to the appropriate tax bracket, and the corresponding tax rate is applied.

It’s essential to note that being in a higher tax bracket does not mean that all of your income is taxed at that rate.

Instead, each portion of your income is taxed at the rate of its respective bracket. For example, if you earn $100,000, only the portion of your income that falls within the highest tax bracket is taxed at the highest rate. The rest is taxed at lower rates in their respective brackets.

Tax Bracket Rates

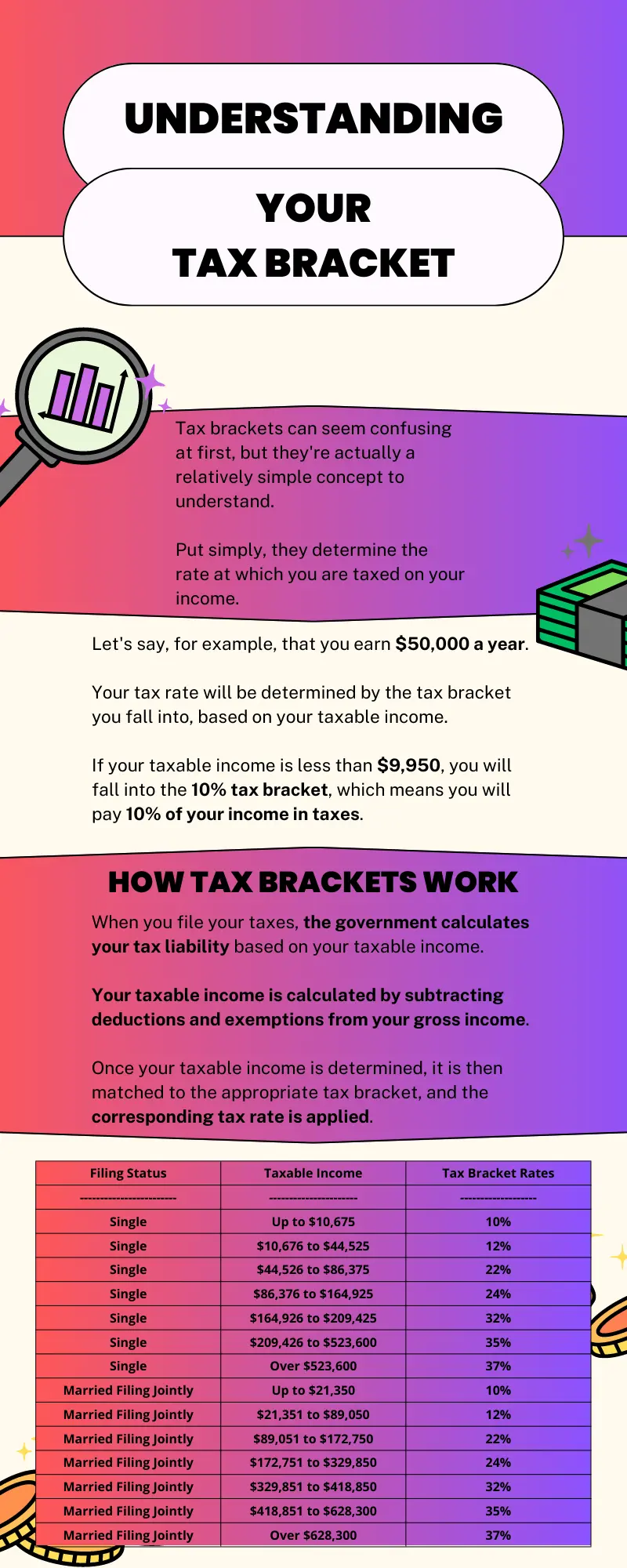

The tax bracket rates vary based on your filing status and income level. The current tax bracket rates in the United States for 2022 are as follows:

| Filing Status | Taxable Income | Tax Bracket Rates |

|---|---|---|

| Single | Up to $10,675 | 10% |

| Single | $10,676 to $44,525 | 12% |

| Single | $44,526 to $86,375 | 22% |

| Single | $86,376 to $164,925 | 24% |

| Single | $164,926 to $209,425 | 32% |

| Single | $209,426 to $523,600 | 35% |

| Single | Over $523,600 | 37% |

| Married Filing Jointly | Up to $21,350 | 10% |

| Married Filing Jointly | $21,351 to $89,050 | 12% |

| Married Filing Jointly | $89,051 to $172,750 | 22% |

| Married Filing Jointly | $172,751 to $329,850 | 24% |

| Married Filing Jointly | $329,851 to $418,850 | 32% |

| Married Filing Jointly | $418,851 to $628,300 | 35% |

| Married Filing Jointly | Over $628,300 | 37% |

How Tax Brackets Affect Your Tax Liability

Understanding how tax brackets work is essential in determining your tax liability. The higher your income, the more you will owe in taxes.

However, being in a higher tax bracket doesn’t necessarily mean that you will pay a higher overall tax rate.

For example, suppose you are single, and your taxable income is $40,000. In that case, you would fall in the 12% tax bracket, and your tax liability would be $4,657.50. However, if your taxable income was $50,000, you would fall in the 22% tax bracket, and your tax liability would be $6,357.50.

Conclusion

In conclusion, tax brackets play a significant role in determining your tax liability. Understanding how they work and how they impact your taxes can help you make informed decisions about your finances.

It’s essential to note that while higher-income earners pay a higher percentage of their income in taxes, being in a higher tax bracket doesn’t necessarily mean that you will pay a higher overall tax rate.

We hope this article has provided you with valuable insights into tax brackets and how they work.