What is a Paycheck?

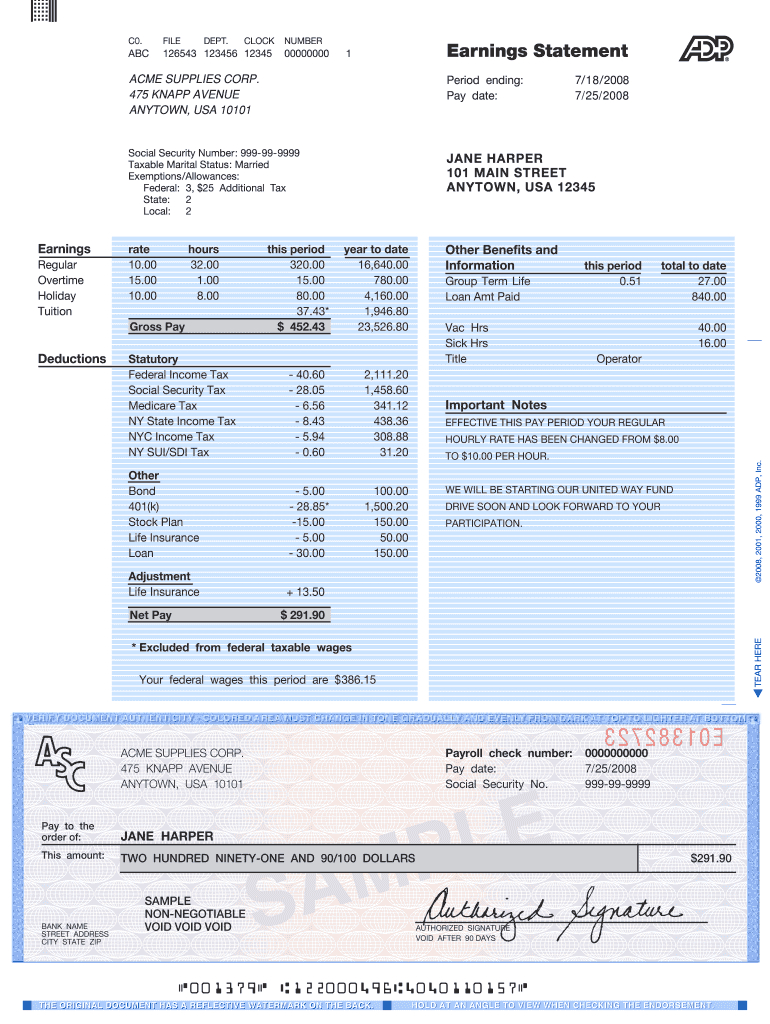

A paycheck is a critical document that is provided to you by your employer. It outlines various details related to your earnings, taxes, and other deductions.

Simply put, it is a record of your financial transactions with your employer. It is usually given to you on a regular basis, such as bi-weekly or monthly, depending on your company’s payroll schedule.

The paycheck provides a breakdown of your gross pay, which is the total amount you have earned before any deductions or taxes. It also lists your taxes, including federal, state, and local taxes, as well as any other taxes or contributions you may be required to make, such as social security or Medicare taxes. These taxes are withheld by your employer and paid on your behalf to the government.

Additionally, your paycheck outlines any deductions that may be taken from your gross pay, such as health insurance premiums, retirement contributions, and other benefits. The amount left after all of these deductions are taken is called your net pay, which is the amount you actually take home.

Understanding your paycheck is crucial because it helps you keep track of your earnings and expenses. By reviewing your paycheck, you can ensure that you are being paid correctly and that all of your deductions and taxes are accurate. It also helps you to plan your budget, allowing you to manage your finances better and achieve your financial goals.

Understanding Your Paycheck

When you receive your paycheck, it can sometimes feel overwhelming to understand all of the different elements that make up your earnings.

However, taking the time to understand your paycheck is crucial in managing your finances effectively. Let’s take a closer look at the various components that make up your paycheck.

Firstly, your paycheck consists of gross pay, which is the total amount of money you have earned before any deductions or taxes. It is the base amount of money you have made for the pay period.

Next, taxes are subtracted from your gross pay. These taxes include federal, state, and local taxes, as well as any other contributions you may be required to make, such as social security or Medicare taxes. Your employer will withhold these taxes on your behalf and pay them to the government.

The next element of your paycheck is deductions. These are any amounts that are taken out of your gross pay for various benefits, such as retirement contributions, health insurance premiums, or other employee benefits. These deductions are subtracted from your gross pay to arrive at your net pay.

Finally, net pay is the amount of money that you take home after all of the taxes and deductions have been subtracted from your gross pay. It is the amount that you can use to pay your bills, save for your future, and enjoy your leisure time.

Understanding these various elements of your paycheck is important because it helps you to ensure that you are being paid correctly and that all of your deductions and taxes are accurate.

It also helps you to plan your budget and manage your finances effectively. So take the time to review your paycheck and understand all of its components, and you’ll be on your way to better financial management.

Benefits of Understanding Your Paycheck

Knowing how to read and understand your paycheck can bring a multitude of benefits that can help you manage your finances better.

One of the primary benefits is that it can help you plan your expenses and budget for future expenses. When you have a clear understanding of how much money you will receive after taxes and deductions, you can create a realistic budget that allows you to allocate your money effectively.

Another benefit of understanding your paycheck is that it allows you to keep track of any errors or discrepancies that may arise.

For example, if you notice that you were paid less than you expected, you can review your paycheck to identify any discrepancies and report them to your employer. This can help you address any issues promptly and avoid financial loss.

Moreover, understanding your paycheck also allows you to take full advantage of your employee benefits. By knowing what deductions are being made, you can ensure that you are receiving the benefits you are entitled to, such as health insurance, retirement contributions, and other employee benefits.

Understanding your paycheck is crucial in managing your finances effectively. It enables you to plan your expenses and budget accordingly, identify errors or discrepancies, and take full advantage of your employee benefits.

Therefore, it is important to take the time to review your paycheck and ensure that you have a clear understanding of its components.

Pay and Benefits

Apart from your paycheck, your employer may also offer additional benefits such as health insurance, retirement plans, paid time off, and other perks. These benefits can be incredibly valuable and can significantly impact your overall compensation package.

Below, I’ll discuss some of the benefits in more detail that your employer may offer. Some employers may offer other perks such as gym memberships, commuter benefits, or flexible work arrangements. By understanding these benefits fully, you can take full advantage of them and improve your overall work experience.

Understanding your pay and benefits package is crucial to making informed decisions about your employment. Take the time to review your benefits package thoroughly, ask questions if needed, and take full advantage of the benefits that your employer offers.

So on to the benefits!

Health Insurance

Health insurance is a type of insurance that helps you pay for medical expenses such as doctor visits, hospital stays, and prescription drugs. Health insurance can be a significant benefit offered by employers, which can save you a lot of money on healthcare costs.

Employers may offer a variety of health insurance plans to choose from, each with different levels of coverage and premiums. You may be required to pay a portion of the premiums, which is the cost of the insurance. This cost is usually deducted from your paycheck.

By having health insurance, you can have peace of mind knowing that you will be covered in case of unexpected medical expenses. You can also take advantage of preventative care services, such as annual check-ups and vaccinations, which can help you stay healthy and catch any potential health issues early.

It is essential to understand the details of your health insurance plan fully. This includes understanding the deductibles, co-pays, and out-of-pocket maximums. These are all important factors that can impact your healthcare costs.

If you have any questions about your health insurance plan, you can reach out to your employer’s HR department or the insurance provider directly. They can provide you with more information and help you understand the details of your coverage.

Health insurance is an essential benefit that can help you save money on medical expenses and stay healthy. By understanding the details of your health insurance plan, you can make informed decisions about your healthcare and take full advantage of the benefits that your employer offers.

Retirement Plans

Retirement plans are an important benefit that employers may offer to help you save for retirement. There are different types of retirement plans, such as 401(k)s or pension plans, and each may have unique features and benefits.

Retirement plans can be an effective way to save for retirement because they often come with tax benefits. Contributions to these plans are typically made before taxes are taken out of your paycheck, which means you can save more money for retirement while reducing your taxable income in the present.

Some employers may also offer matching contributions to your retirement plan, which means they will contribute a certain amount of money to your retirement savings account based on the amount that you contribute. This can be a significant benefit, as it can help you save even more for retirement.

It’s important to understand the details of your retirement plan, including the contribution limits and any fees or penalties associated with withdrawing money early. By planning ahead and regularly contributing to your retirement plan, you can set yourself up for a comfortable retirement.

If you have any questions about your retirement plan, you can speak with your employer’s HR department or a financial advisor. They can help you understand the details of your plan and provide guidance on how to maximize your savings.

Retirement plans are an important benefit that can help you save for retirement and provide financial security in your later years. By understanding the details of your plan and regularly contributing to it, you can set yourself up for a comfortable and worry-free retirement.

Paid Time Off

Paid time off is a fantastic perk that many employers offer to their employees. It allows you to take time off from work without worrying about losing pay. This can be beneficial for a variety of reasons, such as taking a well-deserved vacation or taking care of a sick family member.

Employers may offer different amounts of paid time off, depending on their policies. Some companies may offer a set number of days off per year, while others may use a flexible time off policy, where you can take as much time off as you need as long as you get your work done. It’s important to understand your employer’s policies around paid time off and how to request time off.

It’s also important to note that some employers may offer separate sick days and personal days, while others may combine them into one category of paid time off. Be sure to check with your employer to understand their policies.

Having paid time off can be a great benefit for your mental health and overall well-being. Taking time away from work can help you recharge and come back to work feeling more energized and productive. So, make sure you take advantage of this benefit and take the time off you need to take care of yourself and your loved ones.

Conclusion

Understanding your pay, benefits, and paycheck is essential for managing your finances and planning for the future. By understanding the different elements that make up your paycheck and the benefits offered by your employer, you can make informed decisions that will benefit you in the long run.