The stock market is a platform where investors can buy and sell stocks or shares of ownership in publicly traded companies. It is a vital component of the economy as it provides companies with access to capital and investors with the opportunity to participate in the growth of these companies.

The stock market serves as a barometer of the overall health of the economy and is closely watched by economists, policymakers, and investors alike. Understanding how the stock market works is crucial for investors to make informed decisions and manage their finances effectively.

In this article, I will explore the basics of the stock market, how it operates, the key players involved, and the risks and rewards of investing in it.

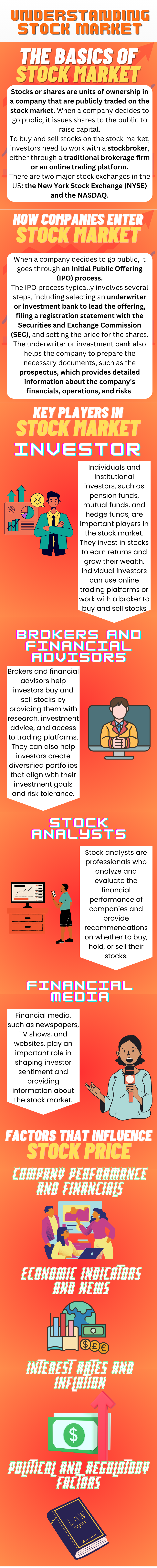

The Basics of The Stock Market

Stocks or shares are units of ownership in a company that are publicly traded on the stock market. When a company decides to go public, it issues shares to the public to raise capital. Investors can then buy and sell these shares on the stock market, and the price of the shares is determined by supply and demand.

To buy and sell stocks on the stock market, investors need to work with a stockbroker, either through a traditional brokerage firm or an online trading platform. Investors can place orders to buy or sell stocks at a specified price or choose to execute a market order, where the broker buys or sells the stock at the prevailing market price.

There are two major stock exchanges in the US: the New York Stock Exchange (NYSE) and the NASDAQ. The NYSE is the largest and oldest stock exchange in the world, and it is known for its iconic trading floor, where traders use hand signals and shouting to execute trades.

The NASDAQ, on the other hand, is an electronic exchange that was established in 1971 and is known for its technology-focused companies. Other notable stock exchanges around the world include the London Stock Exchange, the Tokyo Stock Exchange, and the Shanghai Stock Exchange.

How Companies Enter The Stock Market

When a company decides to go public, it goes through an Initial Public Offering (IPO) process. This involves the company offering its shares to the public for the first time, and the shares are usually sold to institutional investors, such as pension funds and hedge funds, and retail investors, such as individual investors.

The IPO process typically involves several steps, including selecting an underwriter or investment bank to lead the offering, filing a registration statement with the Securities and Exchange Commission (SEC), and setting the price for the shares. The underwriter or investment bank plays a crucial role in the IPO process, as it helps the company to determine the appropriate price for the shares and to market the offering to potential investors.

The underwriter or investment bank also helps the company to prepare the necessary documents, such as the prospectus, which provides detailed information about the company’s financials, operations, and risks. The prospectus is an important document for investors, as it helps them to evaluate the company and make informed investment decisions.

The IPO process is a complex and lengthy process that requires careful planning and execution. However, going public can provide companies with access to capital to fund growth and expansion, and it can also increase their visibility and credibility in the market.

Key Players In The Stock Market

The stock market is made up of various players who participate in buying, selling, and analyzing stocks. Here are the key players in the stock market:

- Investors: Individuals and institutional investors, such as pension funds, mutual funds, and hedge funds, are important players in the stock market. They invest in stocks to earn returns and grow their wealth. Individual investors can use online trading platforms or work with a broker to buy and sell stocks, while institutional investors tend to have dedicated teams of professionals to manage their investments.

- Brokers and financial advisors: Brokers and financial advisors help investors buy and sell stocks by providing them with research, investment advice, and access to trading platforms. They can also help investors create diversified portfolios that align with their investment goals and risk tolerance.

- Stock analysts: Stock analysts are professionals who analyze and evaluate the financial performance of companies and provide recommendations on whether to buy, hold, or sell their stocks. They use various metrics, such as earnings per share, revenue growth, and profit margins, to assess the health of a company and its potential for future growth.

- Financial media: Financial media, such as newspapers, TV shows, and websites, play an important role in shaping investor sentiment and providing information about the stock market. They report on breaking news, company earnings, and market trends, which can influence investors’ decisions to buy or sell stocks.

These key players in the stock market work together to provide liquidity, information, and opportunities for investors to participate in the growth of companies and the economy.

Factors That Influence Stock Prices

Stock prices are influenced by a variety of factors, including:

- Company performance and financials: A company’s financial performance, including its revenue growth, earnings, and profit margins, can have a significant impact on its stock price. Positive financial results can drive up the stock price, while negative results can cause it to fall.

- Economic indicators and news: Economic indicators, such as GDP growth, employment data, and consumer confidence, can affect the stock market as they provide insight into the health of the economy. Positive economic news can boost investor confidence and drive up stock prices, while negative news can have the opposite effect.

- Interest rates and inflation: Changes in interest rates and inflation can affect the stock market as they impact the cost of borrowing and consumer spending. Higher interest rates can make borrowing more expensive and reduce consumer spending, which can lead to lower stock prices. Similarly, high inflation can erode the purchasing power of consumers and reduce demand for goods and services, which can also hurt stock prices.

- Political and regulatory factors: Political events, such as elections and policy changes, can impact the stock market as they can affect the business environment and investor sentiment. Regulatory changes, such as new laws or regulations, can also impact specific industries or companies, which can in turn affect their stock prices.

Stock prices are influenced by a complex interplay of factors, and it is important for investors to stay informed and keep a long-term perspective when making investment decisions. By understanding the factors that influence stock prices, investors can make informed decisions and manage their portfolios effectively.

Types Of Stock Market Orders

When investors buy or sell stocks in the stock market, they can use different types of orders to execute their trades. Here are the most common types of stock market orders:

- Market orders: A market order is an instruction to buy or sell a stock at the current market price. This type of order is executed immediately, and the investor receives the prevailing market price for the stock. Market orders are typically used when investors want to execute their trades quickly and are less concerned with the specific price at which the trade is executed.

- Limit orders: A limit order is an instruction to buy or sell a stock at a specified price or better. This means that the order will only be executed if the stock reaches the specified price or a better price. For example, if an investor wants to buy a stock at $50 or less, they can place a limit order for $50, and the order will only be executed if the stock falls to that price or lower.

- Stop-loss orders: A stop-loss order is an instruction to sell a stock when it reaches a specified price, called the stop price. This type of order is often used to limit potential losses in a stock that has already been purchased. For example, if an investor buys a stock at $60, they can place a stop-loss order for $50, and the order will be executed if the stock falls to that price or lower, limiting their potential losses.

Understanding the different types of stock market orders can help investors make more informed investment decisions and manage their portfolios more effectively.

Risks And Rewards Of Investing In The Stock Market

Investing in the stock market can offer potential rewards, but it also comes with risks. Here are some key factors to consider:

- Potential for high returns and growth: Investing in the stock market can offer the potential for significant returns over time. Historically, the stock market has provided higher returns than many other investment options, such as bonds or savings accounts. By investing in a diversified portfolio of stocks, investors can potentially benefit from the growth of the stock market and the performance of individual companies.

- Risk of losing money and market volatility: Investing in the stock market also comes with risks. Stock prices can be volatile, and individual stocks can lose value quickly, sometimes without warning. This means that investors can lose money if they invest in the wrong stocks or make poor investment decisions. Additionally, external factors such as economic downturns or geopolitical events can impact the stock market and cause volatility.

- Importance of diversification and long-term investing: To manage the risks of investing in the stock market, it’s important to diversify your portfolio and take a long-term perspective. By investing in a variety of stocks across different industries and geographic regions, investors can reduce their exposure to individual company or industry risk. Additionally, taking a long-term approach to investing can help investors weather short-term market fluctuations and benefit from the potential growth of the stock market over time.

Investing in the stock market can offer the potential for significant returns, but it’s important to understand and manage the risks. By diversifying your portfolio, taking a long-term perspective, and staying informed about the factors that can impact the stock market, investors can make more informed investment decisions and increase their chances of success.

Conclusion

Investing in the stock market can seem complex and intimidating, but understanding the basics can help novice investors make more informed investment decisions. Here are some key takeaways:

- The stock market is a marketplace where stocks are bought and sold, and it plays an important role in the economy and in investors’ portfolios.

- Stocks represent ownership in a company, and their prices are determined by supply and demand in the market.

- When companies want to enter the stock market, they often do so through an Initial Public Offering (IPO) process, which involves underwriters and investment banks.

- Key players in the stock market include investors, brokers, financial advisors, stock analysts, and financial media.

- There are several factors that can influence stock prices, including company performance, economic indicators, interest rates, inflation, and political and regulatory factors.

- Investors can use different types of stock market orders, including market orders, limit orders, and stop-loss orders, to execute trades.

- Investing in the stock market can offer potential rewards, but it also comes with risks, including the risk of losing money and market volatility.

- To manage the risks of investing in the stock market, it’s important to diversify your portfolio, take a long-term perspective, and stay informed about the factors that can impact the stock market.

Overall, investing in the stock market requires patience, discipline, and a commitment to ongoing learning and research. By understanding the basics and seeking out reliable information and guidance, novice investors can increase their chances of success in the stock market.