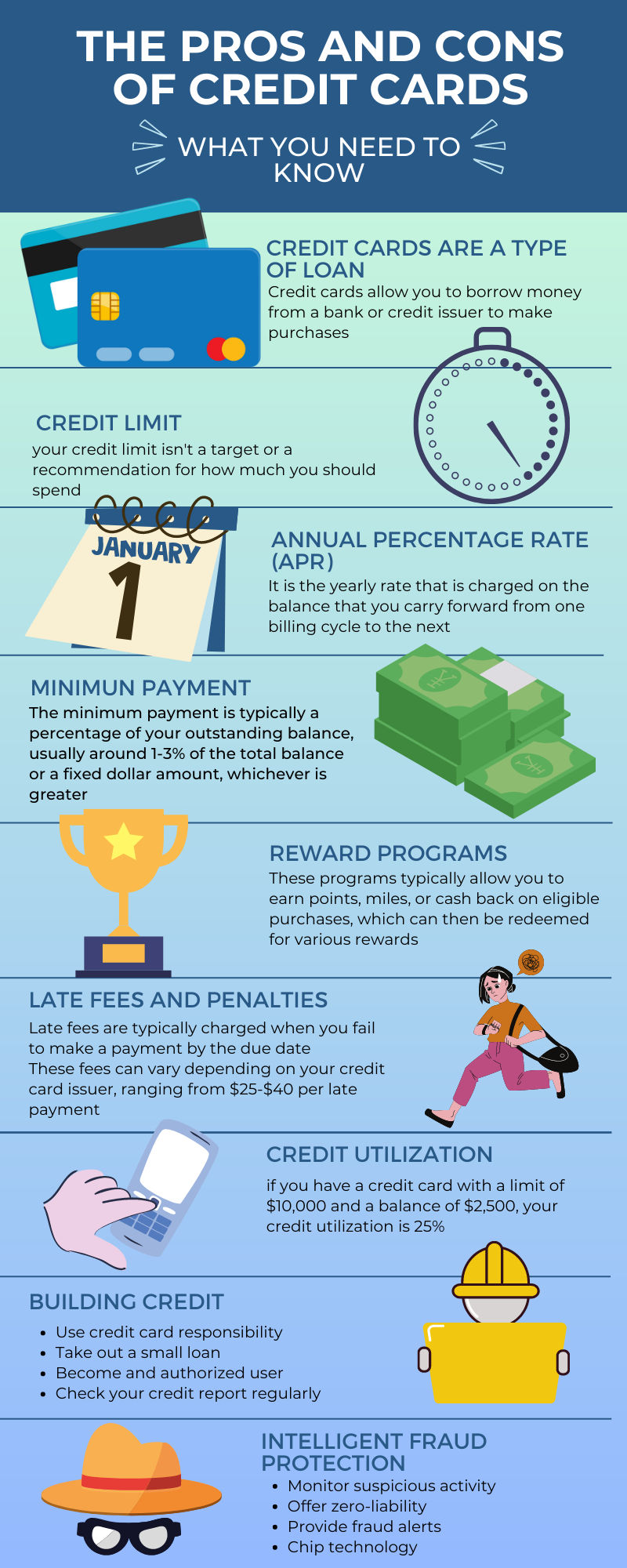

Let’s talk about credit cards – those little pieces of plastic that can often be found in our wallets. While they may seem like a small thing, credit cards can have a big impact on our financial lives. That’s why it’s important to have a good understanding of how they work and how to use them responsibly.

At their core, credit cards are a type of loan that allows you to borrow money from a bank or credit card issuer to make purchases. You’re then required to pay back the borrowed amount, along with interest and fees charged by the issuer. But credit cards aren’t just about borrowing money – they can also come with rewards programs, fraud protection, and other perks.

Unfortunately, credit cards can also lead to debt and financial hardship if they’re not used responsibly. That’s why it’s important to have a solid understanding of how to manage your credit card use, including how to make payments, avoid high interest charges and fees, and keep your credit utilization low.

So, whether you’re just starting out with credit cards or you’re looking to improve your credit card management skills, this blog will cover everything you need to know to make the most of this financial tool. Let’s get started!

Credit Cards Are a Type of Loan

Credit cards have become ubiquitous in our lives and have become an essential tool for managing our finances.

However, it’s important to remember that using a credit card means taking out a loan. When you use your credit card to make a purchase, you are essentially borrowing money from the card issuer. The amount that you borrow is added to your outstanding balance, which accumulates interest and other fees until it is paid back.

Credit card issuers charge interest on the balance that you carry forward from one billing cycle to the next. This interest rate is known as the Annual Percentage Rate (APR) and can vary depending on the credit card issuer, your creditworthiness, and other factors. Interest charges can quickly add up if you carry a high balance or make only the minimum payment each month.

In addition to interest charges, credit cards may also come with other fees, such as annual fees, late fees, cash advance fees, and balance transfer fees. It’s important to read the terms and conditions of your credit card agreement carefully to understand the fees and charges that may apply to your account.

Using a credit card is essentially taking out a loan that needs to be repaid. Understanding the costs associated with credit card use, including interest and fees, is essential for managing your finances effectively and avoiding debt.

Credit Limit

A credit limit is the maximum amount of credit that a credit card issuer is willing to extend to you. This is the maximum amount of money that you can borrow on your credit card. Your credit limit is determined by several factors, including your credit score, income, and credit history.

The credit limit is set by the credit card issuer when you first apply for a credit card. It may be increased or decreased over time depending on your creditworthiness and how you manage your credit card account.

It’s important to remember that your credit limit isn’t a target or a recommendation for how much you should spend. Spending up to your credit limit can negatively impact your credit score and increase the likelihood of accruing debt that you may not be able to pay off.

To avoid overspending, it’s important to set a budget and stick to it. This means only using your credit card for purchases that you can afford to pay off in full when your bill is due. It’s also important to keep your credit utilization low, which is the amount of credit you’re using compared to your total credit limit.

Your credit limit is the maximum amount of credit that a credit card issuer is willing to extend to you. To use your credit card responsibly, it’s important to set a budget, avoid overspending, and keep your credit utilization low.

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is a term used to describe the interest rate that you are charged on any outstanding balance on your credit card. It is the yearly rate that is charged on the balance that you carry forward from one billing cycle to the next_.

The APR is an important factor to consider when using a credit card because it determines how much interest you will be charged on any unpaid balance. The APR is expressed as a percentage and can vary depending on your creditworthiness, credit history, and the type of credit card you have.

It’s important to note that there are different types of APRs that may apply to your credit card. For example, a credit card may have a variable APR, which means that the rate can change based on market conditions. There may also be different APRs for balance transfers, cash advances, and purchases.

It’s important to understand the APR associated with your credit card and how it applies to your account. If you carry a balance on your credit card, the APR can significantly increase the amount of interest that you pay over time. It’s a good idea to pay off your balance in full each month to avoid accruing interest charges.

The APR is an important factor to consider when using a credit card. It determines the amount of interest that you will be charged on any unpaid balance and can significantly impact the cost of using your credit card over time.

Minimum Payment

The minimum payment is the smallest amount of money that you are required to pay each month on your credit card balance to avoid being charged a late payment fee. The minimum payment is typically a percentage of your outstanding balance, usually around 1-3% of the total balance or a fixed dollar amount, whichever is greater.

It’s important to remember that making only the minimum payment each month can lead to increased interest charges and a longer time to pay off your debt. This is because interest is charged on the remaining balance after each payment, and the more you owe, the more interest you’ll accrue.

Paying more than the minimum payment can help you pay off your debt faster and reduce the amount of interest you’ll pay over time. It’s a good idea to pay off your balance in full each month if possible, to avoid accruing interest charges altogether.

If you’re struggling to make your minimum payments, it’s important to contact your credit card issuer as soon as possible to discuss your options. They may be able to offer a payment plan or other assistance to help you manage your debt.

The minimum payment is the smallest amount of money you can pay each month on your credit card balance. Paying more than the minimum payment can help you pay off your debt faster and reduce interest charges over time. If you’re struggling to make your payments, contact your credit card issuer for assistance.

Rewards Programs

Reward programs are a common feature of credit cards that offer incentives for cardholders to use their cards for purchases. These programs typically allow you to earn points, miles, or cashback on eligible purchases, which can then be redeemed for various rewards, such as merchandise, travel, or statement credits.

Reward programs can be a great way to maximize the value of your credit card usage. However, it’s important to understand the terms and conditions of your rewards program, including how you earn and redeem rewards, any fees or restrictions, and the value of the rewards themselves.

Some rewards programs may offer bonus points for specific categories of spending, such as groceries or travel. Others may have limitations on how many points you can earn or how long you have to redeem your rewards before they expire.

It’s also important to consider the annual fee associated with your credit card when evaluating the value of the rewards program. If the annual fee is high, it may cancel out the value of any rewards earned.

Reward programs can be a great way to maximize the value of your credit card usage, but it’s important to understand the terms and conditions of the program and evaluate the value of the rewards compared to any associated fees. If used responsibly, reward programs can provide tangible benefits and make credit card usage more rewarding.

Late Fees and Penalties

Late fees and penalties are charges that credit card issuers apply when you miss a payment or fail to make a payment on time. These fees can add up quickly and make it more difficult to pay off your debt over time.

Late fees are typically charged when you fail to make a payment by the due date. These fees can vary depending on your credit card issuer, but they typically range from $25-$40 per late payment. In addition to late fees, your credit card issuer may also apply a penalty interest rate, which can increase the amount of interest you pay on your balance over time.

It’s important to note that missed payments can also negatively impact your credit score, which can make it more difficult to obtain credit in the future. Late payments can stay on your credit report for up to seven years, and may affect your ability to qualify for loans or credit cards in the future.

To avoid late fees and penalties, it’s important to make payments on time and in full each month. Setting up automatic payments or reminders can help ensure that you don’t miss a payment deadline.

Late fees and penalties can add up quickly and make it more difficult to pay off your debt over time. To avoid these charges, it’s important to make payments on time and in full each month. Setting up automatic payments or reminders can help ensure that you don’t miss a payment deadline and avoid negative impacts on your credit score.

Credit Utilization

Credit utilization is a measure of how much of your available credit you are using on your credit cards. It is calculated by dividing your credit card balance by your credit limit, expressed as a percentage. For example, if you have a credit card with a limit of $10,000 and a balance of $2,500, your credit utilization is 25%.

Credit utilization is an important factor in determining your credit score. Generally, a lower credit utilization is better for your credit score, as it shows that you are using credit responsibly and not relying too heavily on borrowed funds. Experts recommend keeping your credit utilization below 30% to maintain a healthy credit score.

High credit utilization can also negatively impact your ability to obtain new credit, as lenders may view you as a higher risk borrower. Additionally, high credit utilization can lead to higher interest charges and fees on your credit card balances.

To maintain a healthy credit utilization, it’s important to monitor your credit card balances and try to keep them as low as possible. If you find that you’re consistently using a high percentage of your available credit, you may want to consider making larger payments or reducing your overall spending on credit cards.

Credit utilization is a measure of how much of your available credit you are using on your credit cards. Keeping your credit utilization low can help maintain a healthy credit score and reduce the risk of negative impacts on your credit and ability to obtain new credit.

Building Credit

Building credit is an important part of managing your finances and achieving your financial goals. Credit is necessary for obtaining loans, credit cards, and even certain jobs or apartments.

If you don’t have a credit history, it can be difficult to qualify for credit, and if you have a poor credit history, you may be subject to higher interest rates and fees.

There are several ways to build credit, including:

- Using a credit card responsibly: Paying your credit card balance on time and in full each month can help build a positive credit history.

- Taking out a small loan: Taking out a small personal loan and making regular, on-time payments can help establish a credit history.

- Becoming an authorized user: Being added as an authorized user to someone else’s credit card can help build credit, as long as the primary cardholder is making on-time payments.

- Checking your credit report regularly: Monitoring your credit report can help you catch errors and ensure that all information is accurate.

It’s important to remember that building credit takes time and requires responsible financial habits. Making on-time payments, keeping balances low, and avoiding new debt can all contribute to building a positive credit history.

By taking steps to build and maintain good credit, you can improve your financial standing and achieve your long-term financial goals.

Fraud Protection

Fraud protection is a crucial component of credit card ownership, as credit card fraud is a common and growing problem. Credit card fraud can happen in several ways, including unauthorized transactions, identity theft, and phishing scams.

Credit card issuers take several steps to protect cardholders from fraud, including:

- Monitoring for suspicious activity: Credit card issuers use sophisticated algorithms to detect unusual spending patterns, and may contact you if they suspect fraudulent activity on your account.

- Offering zero-liability policies: Many credit card issuers offer zero-liability policies, which protect you from unauthorized charges on your account.

- Providing fraud alerts: Some credit card issuers offer fraud alerts, which can notify you via text message or email if there is suspicious activity on your account.

- Chip technology: Credit cards with chip technology provide an extra layer of security by encrypting your data and making it more difficult for fraudsters to steal your information.

It’s important to take steps to protect yourself from credit card fraud as well, such as keeping your card information secure, monitoring your account regularly, and reporting any suspicious activity to your credit card issuer immediately.

Credit card fraud is a common and growing problem, but credit card issuers take several steps to protect cardholders from fraud, including monitoring for suspicious activity, offering zero-liability policies, providing fraud alerts, and using chip technology.

It’s also important for cardholders to take steps to protect themselves from fraud and to report any suspicious activity to their credit card issuer immediately.

Conclusion

In conclusion, credit cards are a powerful financial tool that can help you manage your expenses, build credit, and earn rewards.

However, it’s important to use credit cards responsibly and understand the potential risks and pitfalls.

Understanding credit limits, APR, minimum payments, rewards programs, late fees, penalties, and credit utilization can help you make informed decisions about how to use credit cards to achieve your financial goals.

Additionally, it’s important to take steps to protect yourself from fraud, as credit card fraud is a common and growing problem.

Credit card issuers offer several protections to help cardholders avoid fraud, but it’s also important to be vigilant and take steps to protect your card information and monitor your account for suspicious activity.

Overall, credit cards can be a useful tool for managing your finances, but it’s important to use them wisely and responsibly. By understanding how credit cards work and taking steps to protect yourself, you can use credit cards to your advantage and achieve your financial goals.