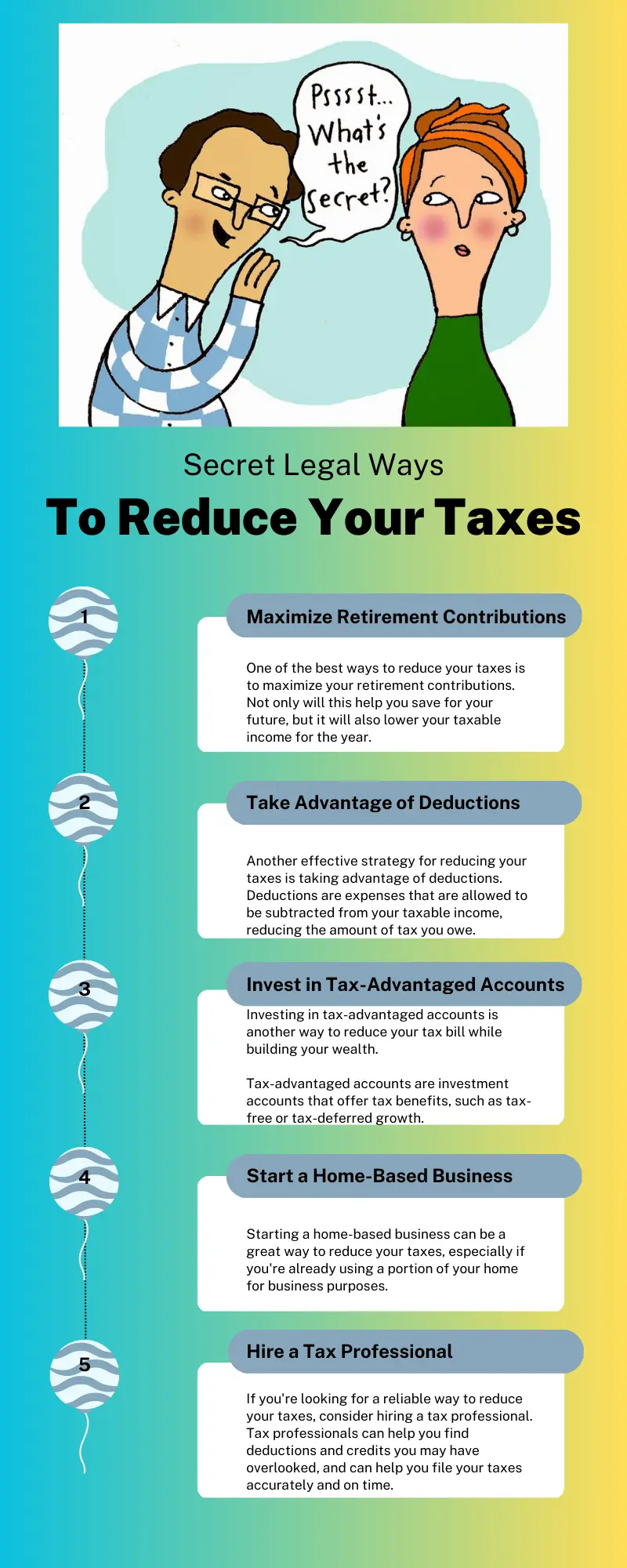

Are you tired of paying high taxes every year and wondering if there are any secret legal ways to reduce your tax bill?

Well, the good news is that there are several strategies you can use to minimize your tax liability and keep more of your hard-earned money.

In this article, we’ll be discussing some of the most effective secret legal ways to reduce your taxes. We’ll cover a variety of strategies, from maximizing retirement contributions to taking advantage of tax deductions and credits, to investing in tax-advantaged accounts, and more.

These tips and tricks will help you save money on your taxes and keep more of your income.

Whether you’re a freelancer, small business owner, or just looking for ways to reduce your tax bill, this article is for you.

We’ll explain each strategy in detail and provide examples to help you understand how they work. We’ll also address some of the most frequently asked questions about reducing taxes, so you’ll have a comprehensive understanding of the topic.

So, grab a cup of coffee, get comfortable, and join us as we explore the secret legal ways to reduce your taxes!

Maximize Retirement Contributions

One of the best ways to reduce your taxes is to maximize your retirement contributions. Not only will this help you save for your future, but it will also lower your taxable income for the year.

For example, let’s say you are a self-employed freelancer who earns $100,000 per year. If you contribute the maximum amount to a SEP-IRA, which is $58,000 for 2021, your taxable income will be reduced to $42,000 for the year.

This means you’ll pay less in taxes and have more money to invest in your business or save for other financial goals.

Contributing to a retirement account is also a great way to build your nest egg for the future. The earlier you start contributing to a retirement account, the more time your money has to grow, and the more money you’ll have when you retire.

It’s important to note that different retirement accounts have different contribution limits and rules.

For example, the maximum contribution limit for a 401(k) in 2021 is $19,500, while the maximum contribution limit for a traditional or Roth IRA is $6,000. Make sure to consult with a financial advisor or tax professional to determine the best retirement account for your financial situation.

Maximizing your retirement contributions is a smart way to reduce your tax bill and save for the future. So, don’t forget to contribute as much as you can to your retirement account each year!

Take Advantage of Deductions

Another effective strategy for reducing your taxes is taking advantage of deductions. Deductions are expenses that are allowed to be subtracted from your taxable income, reducing the amount of tax you owe.

For example, if you are a homeowner, you can deduct the interest you pay on your mortgage from your taxable income. This can significantly reduce your tax bill, especially if you have a high mortgage balance and pay a lot of interest each year.

Other common deductions include charitable contributions, state and local taxes, and business expenses for self-employed individuals.

Keep in mind that there are specific rules and limitations for each deduction, so it’s important to keep accurate records and consult with a tax professional.

One useful tip for taking advantage of deductions is to keep track of your expenses throughout the year.

This can be done using a spreadsheet, a financial app, or a shoebox with receipts. By keeping detailed records, you’ll be better prepared to claim deductions when it’s time to file your taxes.

In summary, taking advantage of deductions is a simple and effective way to lower your tax bill. So, don’t forget to claim all the deductions you are entitled to and keep accurate records of your expenses!

Invest in Tax-Advantaged Accounts

Investing in tax-advantaged accounts is another way to reduce your tax bill while building your wealth.

Tax-advantaged accounts are investment accounts that offer tax benefits, such as tax-free or tax-deferred growth.

For example, a Roth IRA is a tax-advantaged retirement account that allows you to contribute after-tax money, and your investments grow tax-free. This means that when you withdraw money from the account in retirement, you won’t owe any taxes on the earnings.

Another example of a tax-advantaged account is a Health Savings Account (HSA), which is a savings account that is used to pay for medical expenses. Contributions to an HSA are tax-deductible, and the earnings on the account grow tax-free. When you use the money in the account to pay for eligible medical expenses, the withdrawals are also tax-free.

Investing in tax-advantaged accounts not only helps you save money on taxes, but can also help you grow your wealth over time.

By taking advantage of the tax benefits of these accounts, you can reduce your tax bill while maximizing your returns.

Keep in mind that different tax-advantaged accounts have different contribution limits and rules, so it’s important to do your research and consult with a financial advisor or tax professional to determine the best account for your financial situation.

Investing in tax-advantaged accounts is a smart way to reduce your tax bill while building your wealth. So, don’t forget to consider these accounts when planning your investment strategy!

Start a Home-Based Business

Starting a home-based business can be a great way to reduce your taxes, especially if you’re already using a portion of your home for business purposes.

When you have a home-based business, you can deduct a portion of your home expenses, such as rent, utilities, and property taxes, as business expenses.

For example, if you use 20% of your home as a home office for your business, you can deduct 20% of your home expenses as a business expense. This can significantly reduce your tax bill and help you save money.

Starting a home-based business can also provide additional tax benefits, such as deducting the cost of business-related equipment and supplies, and writing off business-related travel expenses.

When starting a home-based business, it’s important to choose a business that fits your skills, interests, and lifestyle. You should also do your research and create a solid business plan to ensure your business is successful.

Starting a home-based business can be a smart way to reduce your taxes while pursuing your entrepreneurial dreams.

So, if you have a passion or skill that can be turned into a business, don’t be afraid to explore this option and take advantage of the tax benefits it offers!

Hire a Tax Professional

If you’re looking for a reliable way to reduce your taxes, consider hiring a tax professional. Tax professionals can help you find deductions and credits you may have overlooked, and can help you file your taxes accurately and on time.

A tax professional can also help you navigate complex tax laws and regulations, and can provide valuable advice on how to structure your finances to reduce your tax burden in the long run.

For example, a tax professional can help you determine whether you should itemize your deductions or take the standard deduction, and can help you plan for retirement and other long-term financial goals.

When hiring a tax professional, it’s important to choose someone who is experienced, reputable, and licensed to practice in your state.

You should also be prepared to provide them with all the necessary financial information and documents they need to prepare your taxes.

Hiring a tax professional can be a smart move if you want to reduce your taxes and ensure that your tax return is accurate and filed on time.

If you’re feeling overwhelmed by taxes, don’t hesitate to reach out to a tax professional for help and guidance!

Conclusion

In conclusion, there are many secret legal ways to reduce your taxes and keep more of your hard-earned money in your pocket.

By maximizing your retirement contributions, taking advantage of deductions, investing in tax-advantaged accounts, starting a home-based business, and hiring a tax professional, you can significantly reduce your tax bill and achieve financial freedom.

Remember, reducing your taxes is not about evading the law or cheating the system. It’s about being smart, strategic, and proactive with your finances.

By taking advantage of the many legal tax-saving strategies available to you, you can create a more secure and prosperous financial future for yourself and your family.

So, whether you’re a business owner, investor, or individual taxpayer, don’t be afraid to explore the many tax-saving opportunities available to you.

With the right mindset, strategy, and guidance, you can navigate the complex world of taxes and achieve financial success. So, go out there and take control of your finances today!