Welcome to my comprehensive guide to mutual funds. If you’re looking to invest in the stock market, you’ve probably come across these investment products, and you’re not alone – mutual funds are incredibly popular among investors.

But what exactly are mutual funds, and how do they work? Let’s dive into the details.

What Are Mutual Funds?

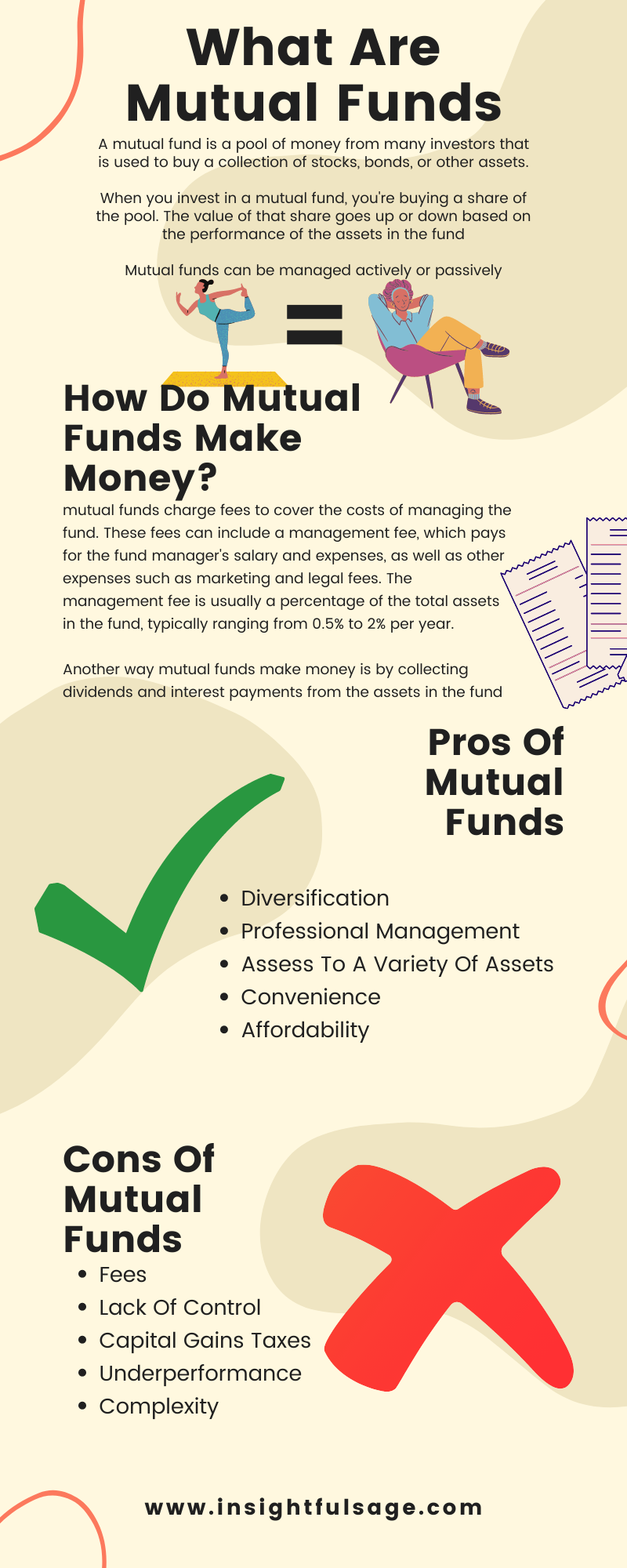

Essentially, a mutual fund is a pool of money from many investors that is used to buy a collection of stocks, bonds, or other assets.

When you invest in a mutual fund, you’re buying a share of the pool. The value of that share goes up or down based on the performance of the assets in the fund.

The idea is that by investing in a collection of assets, you’re spreading out your risk. If one stock in the fund does poorly, the others may do well enough to make up for it.

Mutual funds can be managed actively or passively. With an actively managed fund, a professional fund manager makes decisions about which assets to buy and sell. With a passive fund, the goal is to match the performance of a particular market index, so the fund simply buys all the assets in that index.

One advantage of mutual funds is that they’re a relatively easy way to diversify your portfolio. You can buy shares in a mutual fund that invests in a particular sector, such as technology, or one that invests in a broad range of assets.

In short, mutual funds are a way for small investors to pool their money and invest in a diversified portfolio of assets.

How Do Mutual Funds Make Money?

Mutual funds make money in a few different ways, and understanding these can help you make informed decisions when choosing which funds to invest in.

First, mutual funds charge fees to cover the costs of managing the fund. These fees can include a management fee, which pays for the fund manager’s salary and expenses, as well as other expenses such as marketing and legal fees. The management fee is usually a percentage of the total assets in the fund, typically ranging from 0.5% to 2% per year.

Another way mutual funds make money is by collecting dividends and interest payments from the assets in the fund. For example, if a fund holds stocks that pay dividends, those dividends will be paid to the fund, and the fund can then distribute them to investors.

When a mutual fund sells an asset, such as a stock or bond, for a higher price than it paid for it, the fund realizes a capital gain. These gains can be distributed to investors as well, typically at the end of the year.

Finally, some mutual funds charge sales fees or loads, which are paid when you buy or sell shares in the fund. These fees are usually a percentage of the total amount invested and can vary depending on the fund.

Overall, mutual funds make money by charging fees, collecting dividends and interest, realizing capital gains, and charging sales fees. Understanding these sources of income can help you evaluate the potential costs and benefits of investing in a particular mutual fund.

Pros and Cons of Mutual Funds

Like any investment product, mutual funds have their pros and cons. Here are a few to consider:

Pros

There are many potential benefits to investing in mutual funds. Here are some of the pros:

- Diversification: One of the biggest advantages of mutual funds is that they allow investors to easily diversify their portfolios. By investing in a mutual fund, you’re buying a small piece of a larger portfolio of assets, which can help spread out your risk.

- Professional Management: Many mutual funds are managed by experienced professionals who have access to research and analysis that individual investors may not have. This can potentially lead to better investment decisions and higher returns.

- Access To A Variety Of Assets: Mutual funds can invest in a wide range of assets, from stocks and bonds to real estate and commodities. This can give investors access to a diverse set of investment opportunities that they might not be able to access on their own.

- Convenience: Investing in mutual funds is relatively easy and straightforward. You can buy and sell shares in the fund through a broker or online platform, and the fund will handle the buying and selling of assets within the portfolio.

- Affordability: Many mutual funds have low minimum investment requirements, making them accessible to small investors. Additionally, because the costs of managing the fund are shared among all investors, the fees for mutual funds can be lower than the fees for managing a portfolio of individual assets.

Overall, mutual funds can be a convenient and cost-effective way for investors to access a diverse range of assets and benefit from professional management.

Cons

While mutual funds offer many potential benefits, there are also some potential drawbacks to consider. Here are some of the cons:

- Fees: Mutual funds charge fees to cover the costs of managing the fund, and these fees can add up over time. Even a small difference in fees can have a significant impact on your returns over the long term.

- Lack Of Control: When you invest in a mutual fund, you’re giving up some control over your investments to the fund manager. While this can be a good thing if the manager is experienced and knowledgeable, it can also be frustrating if you don’t agree with the manager’s decisions.

- Capital Gains Taxes: When a mutual fund sells assets for a profit, the fund will realize a capital gain, and investors may be subject to capital gains taxes on those gains. This can potentially reduce your returns.

- Underperformance: While many mutual funds are managed by experienced professionals, not all managers are created equal. Some funds may underperform their benchmarks or other funds in the same category, which can lead to lower returns.

- Complexity: Mutual funds can be complex, with many different types of fees, share classes, and investment strategies to navigate. This can make it difficult to compare different funds and make informed investment decisions.

Overall, mutual funds can be a convenient and cost-effective way to invest, but they’re not without their drawbacks. It’s important to carefully consider the potential costs and benefits of investing in mutual funds and to do your research before making any investment decisions.

Conclusion

In conclusion, mutual funds can be a valuable investment tool for many investors. They offer the potential for diversification, professional management, and access to a wide range of assets, all while being convenient and affordable.

However, like any investment, there are also potential drawbacks to consider. Fees can eat into your returns, and lack of control and complexity can make it difficult to fully understand and manage your investments. Additionally, not all mutual funds are created equal, and some may underperform or have other issues that can impact your returns.

When deciding whether or not to invest in mutual funds, it’s important to weigh the potential pros and cons, and to carefully research any funds you’re considering. Consider your investment goals and risk tolerance, and look for funds with a strong track record of performance and low fees. With the right approach, mutual funds can be a valuable addition to your investment portfolio.