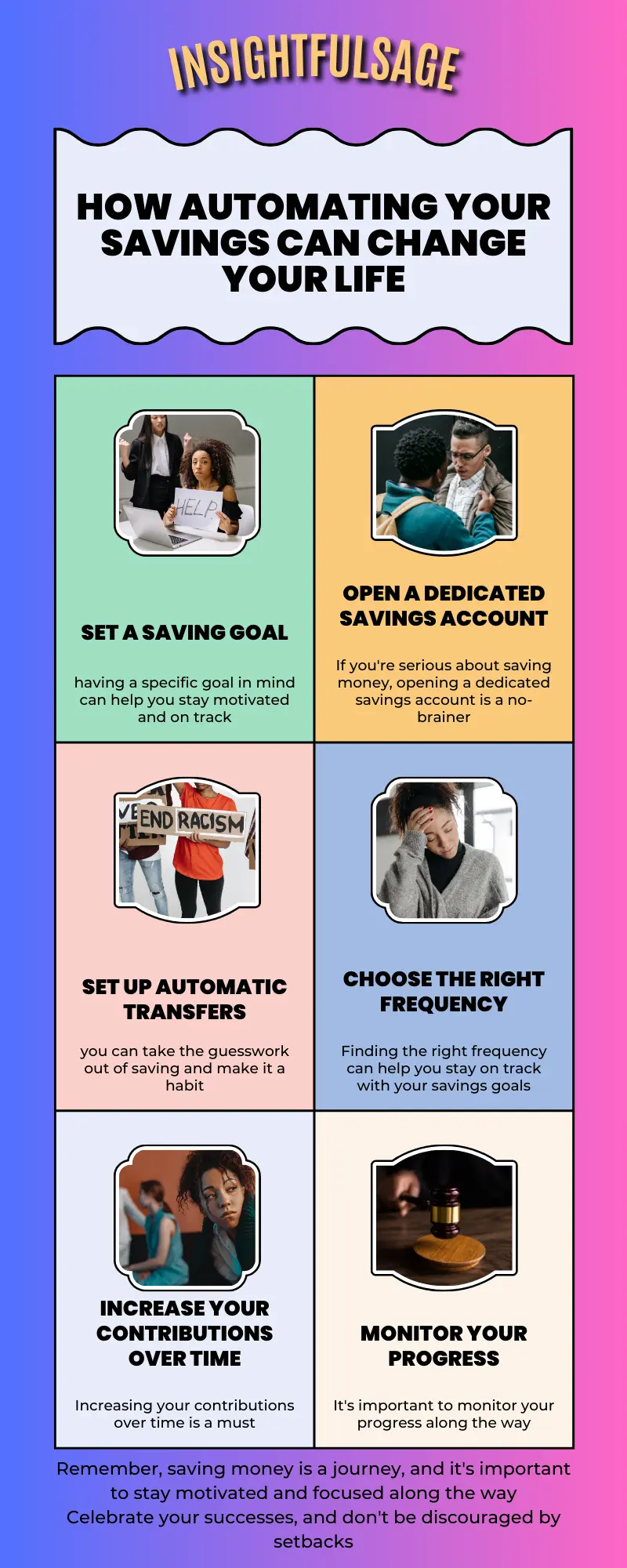

Saving money is an essential component of financial health, but it can be challenging to consistently set aside money each month. That’s where automating your savings comes in.

By setting up a system to automatically save a portion of your income, you can take the guesswork out of saving and make it a habit.

Automating your savings can help you reach your financial goals, whether you’re saving for a down payment on a house, building an emergency fund, or planning for retirement. By setting up automatic transfers, you can ensure that a portion of your income is set aside for savings before you have the chance to spend it.

This makes it easier to stay on track and avoid dipping into your savings when unexpected expenses arise.

By taking the time to set up an automated savings plan, you can free up mental energy to focus on other aspects of your financial life, such as reducing debt, investing, or building your career.

Keep reading to learn how to get started with automating your savings and take the first step towards achieving your financial goals.

Set A Savings Goal

When it comes to saving money, setting a goal can be a game-changer. It’s one thing to vaguely aspire to “save more money” having a specific goal in mind can help you stay motivated and on track.

A savings goal can be anything that requires money, from buying a new car to planning a dream vacation to paying off debt. The key is to make your goal specific, measurable, and achievable.

For example, instead of saying “I want to save more money,” try “I want to save $5,000 for a down payment on a house in the next 12 months.”

Setting a savings goal can also help you identify and prioritize your spending. When you have a specific goal in mind, you can evaluate your current spending habits and make adjustments to allocate more money towards your savings goal.

For example, if you’re saving for a trip, you might cut back on eating out or cancel a subscription service to free up more money for your travel fund.

Your savings goal should be personal and meaningful to you. It should motivate you to make changes and stick to your plan. Setting a goal is just the first step towards achieving your financial dreams. Keep reading to learn more about how to make your savings goal a reality.

Open A Dedicated Savings Account

If you’re serious about saving money, opening a dedicated savings account is a no-brainer. Having a separate account for your savings can help you avoid the temptation to dip into your funds for everyday expenses. Plus, it can be a helpful visual reminder of your progress towards your savings goal.

When choosing a savings account, look for one that offers a competitive interest rate and low fees. Some banks also offer automatic savings plans, where you can set up automatic transfers from your checking account to your savings account. More on this in the point below.

This can help you stay on track with your savings plan and avoid forgetting to make deposits.

Having a dedicated savings account can also give you peace of mind when it comes to unexpected expenses. If you have an emergency fund, you can rest easy knowing that you have a cushion to fall back on in case of a job loss or medical emergency.

Your savings account is just one piece of the puzzle when it comes to financial health. Keep reading to learn more about how to automate your savings and stay on track towards your goals.

Set Up Automatic Transfers

Let’s face it, saving money isn’t always easy. We all have good intentions, but sometimes life gets in the way.

That’s why setting up automatic transfers is a game-changer. By setting up a recurring transfer from your checking account to your savings account, you can take the guesswork out of saving and make it a habit.

Automatic transfers can be set up on a schedule that works best for you, whether it’s weekly, bi-weekly, or monthly.

This means you can stay on track with your savings plan without having to remember to make a deposit each time. Plus, it helps you avoid the temptation to spend the money elsewhere.

For example, let’s say you’re saving for a down payment on a house. You can set up a recurring transfer of $100 from your checking account to your savings account every other week. This way, you’re consistently setting aside money towards your goal without having to think about it.

Automatic transfers are just one way to make saving money easier. Keep reading to learn more about how to make saving a habit and reach your financial goals. With a little bit of planning and discipline, you can build a solid financial foundation that will serve you well for years to come.

Choose The Right Frequency

When it comes to saving money, consistency is key. That’s why it’s important to choose the right frequency for your automatic transfers. Finding the right frequency can help you stay on track with your savings goals without feeling overwhelmed.

If you’re paid bi-weekly, you might consider setting up automatic transfers to coincide with your paychecks.

This way, you can set aside a portion of your income each time you get paid without having to think about it. Alternatively, you might choose to set up monthly transfers if that aligns better with your budgeting cycle.

Remember, the right frequency for your automatic transfers will depend on your personal preferences and financial situation. The most important thing is to choose a schedule that you can stick to over the long term.

For example, let’s say you’re saving for a vacation that’s six months away. If you need to save $1,000 for your trip, you might set up automatic transfers of $167 every month to your savings account. This way, you’ll have the money you need when it’s time to book your trip without feeling overwhelmed by the savings goal.

Increase Your Contributions Over Time

If you’re serious about reaching your savings goals, increasing your contributions over time is a must. As your income grows and your expenses change, it’s important to reevaluate your savings plan and adjust your contributions accordingly.

One way to increase your contributions over time is to make small incremental increases.

For example, you might start by saving 5% of your income and gradually increase that to 10% over the course of a year. This way, you won’t feel overwhelmed by the change and can gradually adjust to the new savings rate.

Another way to increase your contributions is to make lump sum deposits whenever possible. If you receive a bonus at work or a tax refund, consider putting that money towards your savings goals. This can help you accelerate your progress towards your goals and reach them more quickly.

Remember, the key to increasing your contributions over time is to be flexible and open to change. Your financial situation is likely to change over time, so it’s important to adjust your savings plan accordingly.

For example, let’s say you’re saving for a new car. You might start by saving $200 per month, but as your income grows, you might increase that to $300 or $400 per month. This way, you’ll be able to reach your savings goal more quickly and afford the car you really want.

Monitor Your Progress

Saving money is a journey, and like any journey, it’s important to monitor your progress along the way. Keeping an eye on your savings account can be a great motivator to keep going, and it can also help you identify areas where you can improve your savings plan.

Monitoring your progress can be as simple as checking your savings account balance regularly. You might also consider tracking your progress towards specific savings goals.

For example, if you’re saving for a down payment on a house, you can set a target savings goal and track your progress towards that goal.

Another way to monitor your progress is to celebrate your successes along the way. When you reach a savings milestone, take a moment to acknowledge your hard work and the progress you’ve made towards your financial goals.

Remember, monitoring your progress is about more than just looking at numbers. It’s about recognizing the positive changes you’re making in your financial life and feeling motivated to keep going.

For example, let’s say you’re saving for a big trip abroad. By monitoring your progress, you can see how much closer you’re getting to your savings goal with each passing month. Seeing your savings account balance grow can be a great motivator to keep saving, and it can also help you make adjustments to your savings plan if needed.

Conclusion

Automating your savings is one of the most effective ways to reach your financial goals.

By setting a savings goal, opening a dedicated savings account, setting up automatic transfers, choosing the right frequency, increasing your contributions over time, and monitoring your progress, you can make saving money a habit and build a solid financial foundation.

Remember, saving money is a journey, and it’s important to stay motivated and focused along the way.

Celebrate your successes, and don’t be discouraged by setbacks. If you need to adjust your savings plan, don’t be afraid to do so. The key is to stay committed to your long-term goals and make saving money a habit.

At the end of the day, the benefits of automating your savings are many. You’ll have more control over your finances, you’ll be better prepared for unexpected expenses, and you’ll be able to reach your financial goals more quickly.

So what are you waiting for? Start automating your savings today and take the next step towards a more financially secure future.