Buying a house is one of the biggest investments you can make in your lifetime, and it all starts with saving up for a down payment.

For many people, the idea of saving tens of thousands of dollars for a down payment can be daunting, and it’s easy to feel overwhelmed by the process.

But don’t worry, it’s not impossible! With a little bit of planning and dedication, you can make your dream of owning a home a reality.

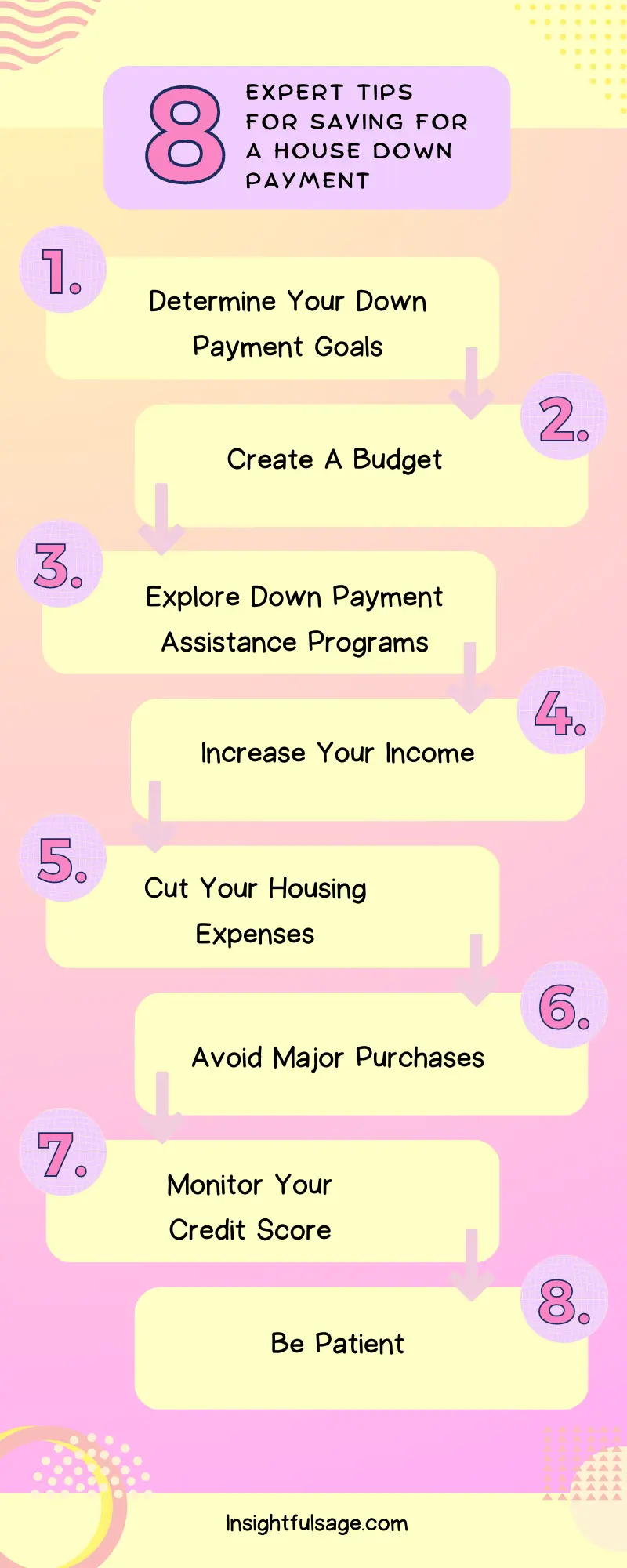

In this blog, we’re going to explore expert tips and tricks for saving for a house down payment. From setting a realistic goal to finding down payment assistance programs, we’ll cover everything you need to know to start saving for your future home.

We’ll also provide advice on how to increase your income, cut expenses, and monitor your credit score to help you qualify for better loan terms.

While the process of saving for a down payment may seem challenging, remember that it’s an achievable goal. With the right mindset and a bit of effort, you can make your dream of homeownership a reality. So, grab a cup of coffee, sit back, and let’s dive into the world of saving for a house down payment!

Determine Your Down Payment Goal

One of the biggest factors in saving for a house down payment is figuring out your down payment goal.

It’s kind of like having a target to aim for – it gives you a clear idea of how much you need to save and helps you stay motivated.

Generally speaking, a down payment is a percentage of the home’s purchase price that you pay upfront, while the rest is financed through a mortgage.

Most experts recommend putting down at least 20% of the purchase price to avoid paying private mortgage insurance (PMI) and to reduce your monthly mortgage payments.

But don’t worry if you can’t afford 20% right away! There are programs and loans that allow for smaller down payments. You can even start with a smaller down payment and then pay down more later to get to 20%.

To determine your down payment goal, you can use online calculators or speak with a lender. They’ll take into account the purchase price of the home, your income, and your current debt load to give you an idea of how much you need to save.

Remember, your down payment goal is just a starting point – it’s up to you to determine what you’re comfortable with and what you’re willing to sacrifice to achieve your goal. With some planning and dedication, you can make your dream of homeownership a reality!

Create A Budget

Let’s talk about budgeting! I know, it’s not the most exciting topic, but creating a budget is a crucial step in saving for a house down payment.

To create a budget, you need to know how much money you’re bringing in each month and how much you’re spending.

Start by tracking your expenses for a few months to get a clear picture of where your money is going. This will help you identify areas where you can cut back and save more.

When you’re creating your budget, don’t forget to include your down payment savings goal as a monthly expense. This will help you stay on track and make sure you’re putting aside enough money each month.

There are a variety of budgeting tools and apps available to help you, from spreadsheets to mobile apps. Find one that works for you and use it to keep track of your income, expenses, and savings.

Creating a budget doesn’t mean you have to give up all the things you love – it’s about finding a balance between your wants and needs.

You can still enjoy your daily latte, just maybe not every day. And don’t forget to reward yourself for sticking to your budget – treat yourself to a night out or a small purchase once in a while.

With a solid budget in place, you’ll be on your way to achieving your down payment goal and one step closer to owning your dream home!

Explore Down Payment Assistance Programs

If you’re struggling to come up with a large down payment for a house, don’t fret – there are down payment assistance programs available to help.

These programs are designed to provide financial assistance to homebuyers who may not have enough money saved for a down payment.

There are various types of down payment assistance programs, and eligibility requirements vary by state and program. Some programs are offered through state or local governments, while others are offered by non-profit organizations or even employers.

Some programs provide grants or forgivable loans that can be used towards a down payment or closing costs, while others offer low-interest loans that can be paid back over time.

While Some programs may require the homebuyer to complete a homebuyer education course or purchase a home in a designated area.

To explore down payment assistance programs, start by contacting a housing counseling agency or a lender who is familiar with these programs. They can help you determine if you’re eligible and what programs are available in your area.

Keep in mind that while down payment assistance programs can be a great help, they may have certain restrictions or requirements. Make sure you understand the terms of the program before accepting any assistance.

By exploring down payment assistance programs, you may be able to make your dream of homeownership a reality, even if you don’t have a large down payment saved up.

Increase Your Income

When you’re saving for a down payment on a house, increasing your income can be a great way to reach your goal faster. There are a variety of ways to increase your income, depending on your skills and interests.

One option is to look for a higher paying job or to ask for a raise at your current job. If that’s not an option, you can consider taking on a side hustle or freelance work.

There are many online platforms where you can offer your services, from writing and editing to graphic design and programming.

Another option is to sell items you no longer need or use. Consider having a yard sale or selling items online through platforms like eBay or Craigslist. You can also look into selling handmade items on platforms like Etsy or Redbubble.

If you have a spare room in your home, consider renting it out on a short-term basis through platforms like Airbnb or Vrbo. Or, if you have a skill or hobby that you can teach, consider offering classes or workshops in your community.

Increasing your income can also mean finding ways to save money on expenses. Look for ways to reduce your bills, such as negotiating lower rates for services like cable and internet or shopping around for better deals on insurance.

By finding ways to increase your income, you can boost your savings and get closer to your down payment goal. Just remember to be mindful of your overall work-life balance and don’t overextend yourself.

Cut Your Housing Expenses

When you’re saving for a down payment on a house, every dollar counts. One way to free up more money for your savings is by cutting your housing expenses.

This doesn’t necessarily mean moving to a smaller apartment or giving up your dream home – there are many ways to reduce your housing costs.

Consider refinancing your current mortgage or negotiating with your landlord for a lower rent. You can also look for ways to save on utilities by using energy-efficient appliances and turning off lights and electronics when not in use.

If you’re looking for a new place to live, consider a less expensive area or a smaller home that’s still suitable for your needs. You can also look for rent-to-own options or find a roommate to split expenses with.

Another option is to consider alternative housing options, such as tiny homes, shipping container homes, or even converted school buses. While not for everyone, these options can offer a more affordable and unique housing experience.

Finally, consider ways to earn money from your home. If you have a spare bedroom or a garage, consider renting it out for storage or as a workspace.

By cutting your housing expenses, you can free up more money for your down payment savings and get one step closer to owning your dream home.

Avoid Major Purchases

When you’re saving for a down payment on a house, it’s important to avoid making major purchases that can derail your savings plan.

Big-ticket items like a new car or a luxurious vacation can quickly eat into your savings, making it harder to reach your down payment goal.

Before making any large purchases, consider whether they’re truly necessary or if you can hold off until after you’ve purchased your home. If you do need to make a big purchase, try to pay for it in cash or consider financing it with a low-interest loan.

It’s also important to avoid taking on additional debt while you’re saving for a down payment. This means avoiding opening new credit cards or taking out loans that can add to your monthly expenses and make it harder to save.

If you do have outstanding debts, focus on paying them off as quickly as possible. This can help you improve your credit score, which will be important when you apply for a mortgage.

Remember, the more money you can save for your down payment, the better. A larger down payment can help you secure a better interest rate on your mortgage, which can save you thousands of dollars in interest over the life of the loan.

By avoiding major purchases and focusing on saving, you can put yourself in a better position to achieve your goal of homeownership.

Monitor Your Credit Score

Your credit score is one of the most important factors that lenders consider when you apply for a mortgage.

A higher credit score can mean a better interest rate and lower monthly payments, so it’s important to monitor your credit score and take steps to improve it if necessary.

There are several ways to monitor your credit score, including signing up for free credit monitoring services or requesting a copy of your credit report from each of the major credit bureaus.

Reviewing your credit report regularly can help you spot errors or inaccuracies that could be dragging down your score.

To improve your credit score, focus on paying your bills on time and reducing your overall debt. If you have outstanding debts, consider creating a repayment plan or working with a credit counselor to get back on track.

Avoid opening new credit cards or taking on additional debt while you’re saving for a down payment. These actions can lower your credit score and make it harder to secure a mortgage.

Remember, improving your credit score takes time, so it’s important to start early and be consistent in your efforts.

By monitoring your credit score and taking steps to improve it, you can put yourself in a better position to secure a mortgage with a low interest rate and affordable monthly payments.

Be Patient

Saving for a down payment on a house can be a long and challenging process. It requires discipline, hard work, and patience.

While it can be tempting to rush into buying a home, it’s important to take your time and make sure you have enough money saved up for a down payment and other associated costs.

Be patient with the process and trust that your efforts will pay off in the long run. Remember, homeownership is a big financial commitment, and it’s important to be financially prepared before taking the plunge.

To help you stay patient and motivated, set small, achievable goals along the way. Celebrate each milestone you reach, whether it’s saving your first $5,000 or reaching 50% of your down payment goal.

Don’t be discouraged if you encounter setbacks along the way. Unexpected expenses or changes in your financial situation can happen, but it’s important to stay focused on your end goal.

Remember, it’s not a race. Take your time to find the right home for you and your family, and don’t be afraid to walk away from a home that’s not the right fit.

By being patient and taking the time to save for a down payment, you can set yourself up for a successful and fulfilling homeownership journey.