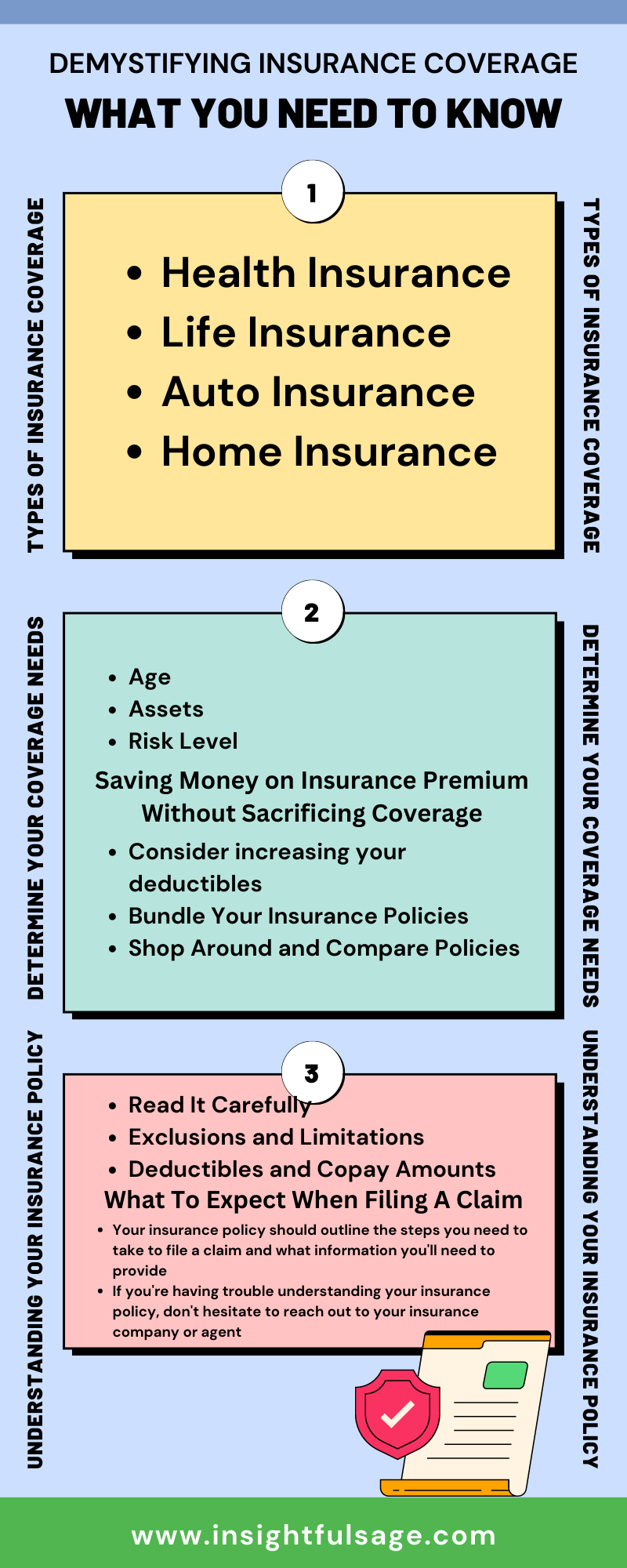

Have you ever found yourself staring at an insurance policy and feeling completely lost? Don’t worry, you’re not alone!

Insurance coverage can be confusing, and it’s hard to know if you’re getting the right amount of coverage for your needs. That’s why I’ve created this blog post to demystify insurance coverage and help you understand what you’re paying for.

Whether you’re new to insurance or have had a policy for years, it’s essential to have a good understanding of what your coverage includes.

It can mean the difference between financial security and financial ruin if something unexpected happens.

I’ll cover everything from the types of insurance coverage available to how to determine your coverage needs, and I’ll explain common insurance terms, so you can read your policy with confidence.

I know that insurance coverage isn’t the most exciting topic, but I promise to make it as straightforward and easy to understand as possible.

By the end of this blog post, you’ll be equipped with the knowledge you need to choose the right insurance policy for your needs, understand what you’re paying for, and feel more confident when you need to file a claim.

I’ve divided the blog in 3 sections to make it easier for anyone to follow along, So, let’s get started!

1 Types Of Insurance Coverage

Awesome, let’s talk about Section 1: Types of Insurance Coverage. Insurance coverage can come in many different forms, and it can be tough to know which one is right for you.

That’s why I’m going to break down the most common types of insurance coverage and explain their pros and cons.

Health Insurance

First up, we have health insurance. Health insurance is probably the most well-known type of insurance coverage, and for a good reason.

It can help you pay for medical expenses, including doctor visits, hospital stays, and prescription drugs.

Health insurance policies can vary widely, from comprehensive coverage to more limited plans, and it can be tricky to determine which one is best for your needs.

A major benefit of health insurance is that it can help you avoid paying exorbitant medical bills out of pocket, which can be incredibly helpful in case of emergencies.

Life Insurance

Next, let’s talk about life insurance. Life insurance is a type of coverage that provides a lump sum payment to your beneficiaries when you pass away. It’s intended to provide financial security for your loved ones after you’re gone, and it can be especially helpful for families with dependents.

Life insurance policies can be term policies that last for a specific period or permanent policies that last for the rest of your life.

The benefits of life insurance can be used for a variety of expenses, including funeral costs, outstanding debts, or your children’s education.

Auto Insurance

Moving on to auto insurance. If you own a car, you probably know that auto insurance is required by law in most states.

Auto insurance can help cover the costs of repairs or medical bills in case of an accident, theft, or damage to your vehicle.

Auto insurance policies can vary depending on the level of coverage you need and the value of your car.

In some cases, insurance companies may offer discounts if you have a good driving record or if you install safety features in your car.

Home Insurance

Finally, we have home insurance. Home insurance can help protect your home and your possessions in case of damage or theft.

It can provide coverage for things like natural disasters, fire, theft, and liability claims.

Home insurance policies can vary widely depending on your location, the value of your home, and the level of coverage you need. Home insurance can also include coverage for additional living expenses if you’re forced to leave your home due to damage or repairs.

Overall, choosing the right type of insurance coverage depends on your individual needs and situation. Take some time to research the different options available and speak with an insurance agent to help determine what type of coverage is best for you.

Understanding the different types of insurance coverage available can help you make an informed decision and give you peace of mind knowing that you’re protected.

2 Determine Your Coverage Needs

Let’s dive into Section 2: Determining Your Coverage Needs. Figuring out how much insurance coverage you need can be overwhelming, but it’s a very important step in protecting yourself and your assets.

I’ll go over the factors you should consider when determining your coverage needs and give you some tips to help you save money on insurance premiums.

Age

One of the first things to consider is your age and health status.

If you’re young and healthy, you may not need as much coverage as someone who is older or has preexisting conditions.

However, it’s important to keep in mind that unexpected medical emergencies can happen to anyone, regardless of age or health status.

Assets

Your assets are another important factor to consider when determining your coverage needs. If you own a home or have significant savings, you may need more insurance coverage than someone who rents and has little to no savings.

The more assets you have, the more you have to lose in case of an accident or unexpected event.

Risk Level

Assessing your risk level is also important when determining your coverage needs. For example, if you live in an area prone to natural disasters, you may need more home insurance coverage than someone who lives in a less risky area. If you drive a lot or have a long commute, you may need more auto insurance coverage.

Saving Money On Insurance Premium Without Sacrificing Coverage

When it comes to saving money on insurance premiums, there are a few things you can do. First, consider increasing your deductibles. A higher deductible means you’ll have to pay more out of pocket if something happens, but it can also lower your premiums.

Another way to save money is to bundle your insurance policies. Many insurance companies offer discounts if you have multiple policies with them, such as home and auto insurance.

It’s also important to shop around and compare insurance policies from different companies.

Don’t be afraid to ask questions and make sure you understand what each policy covers and what it doesn’t. You can also ask for discounts based on your profession, good driving record, or other factors that may make you a lower risk.

In summary, determining your coverage needs requires you to consider your age, health status, assets, and risk level. It can be a bit overwhelming, but taking the time to do your research and speak with an insurance agent can help you make an informed decision.

And, by taking steps to save money on insurance premiums, you can protect yourself and your assets without breaking the bank.

3 Reading And Understanding Your Insurance Policy

Great, let’s move on to Section 3: Reading and Understanding Your Insurance Policy. It’s important to carefully read and understand your insurance policy to ensure you know what’s covered and what’s not.

Insurance policies can be complex, with legal terms and conditions that can be difficult to understand. However, we’re here to help break it down for you.

Read It Carefully

The first thing you should do when you receive your insurance policy is to read it carefully.

Take the time to go through it page by page and make note of any questions or concerns you have. You should also pay attention to the policy’s effective dates and coverage limits, which can vary depending on the type of insurance you have.

Exclusions And Limitations

Next, pay attention to the exclusions and limitations section of the policy.

This section lists what’s not covered under your policy, and it’s important to understand these exclusions to avoid surprises later on.

For example, your health insurance policy may not cover cosmetic procedures or experimental treatments.

Deductibles And Copay Amounts

Another important section of your insurance policy is the deductible and copay section.

The deductible is the amount you’ll have to pay out of pocket before your insurance kicks in, while the copay is a fixed amount you’ll pay for certain medical services.

Make sure you understand what your deductible and copay amounts are, as they can impact how much you’ll have to pay for medical expenses.

What To Expect When Filing A Claim

Finally, make sure you know how to file a claim if something happens.

Your insurance policy should outline the steps you need to take to file a claim and what information you’ll need to provide.

It’s a good idea to keep a copy of your insurance policy and any relevant documents in a safe place in case you need to refer to them later.

If you’re having trouble understanding your insurance policy, don’t hesitate to reach out to your insurance company or agent. They can help answer any questions you have and provide clarification on any confusing terms or conditions.

In summary, reading and understanding your insurance policy is crucial to making sure you’re properly covered and prepared for any unexpected events.

Pay attention to the effective dates, coverage limits, exclusions and limitations, deductible and copay amounts, and claims process. And if you’re unsure about anything, don’t be afraid to ask for help.

Conclusion

Congratulations, you’ve made it to the end of my guide to demystifying insurance coverage! I hope that this blog has helped you understand the ins and outs of insurance policies and how to determine your coverage needs.

Remember, insurance is an investment in your peace of mind and financial security, so taking the time to understand your policy can pay off in the long run.

While insurance policies can be complex and overwhelming, we hope that our friendly and informal approach has helped make the information more accessible and easier to understand.

By taking the time to read and understand your policy, you can ensure that you’re properly covered and prepared for any unexpected events.

Remember, insurance coverage is not a one-size-fits-all solution. Everyone’s needs are unique, and what works for one person may not work for another.

That’s why it’s important to do your research, consider your individual circumstances, and consult with an insurance agent if you have any questions or concerns.

At the end of the day, insurance coverage is all about protecting yourself and your assets.

With the right coverage in place, you can have peace of mind knowing that you’re prepared for whatever life may throw your way. Thanks for reading, and I wish you the best of luck on your insurance coverage journey!