Creating a budget as a couple is an essential step towards financial stability and achieving shared financial goals. When you establish a budget together, you can gain a better understanding of your combined income and expenses, and you can work together to make informed financial decisions.

However, budgeting as a couple can also be challenging. Each person may have different spending habits, financial goals, and attitudes towards money, which can lead to disagreements and conflicts. It’s important to have open and honest communication about finances and to work together to find a budgeting method that works for both of you.

Another common challenge is sticking to the budget. It’s easy to get sidetracked by unexpected expenses or to overspend in certain categories. Regularly reviewing your budget and adjusting as needed can help you stay on track. Additionally, creating a joint bank account and tracking your spending can also help keep you accountable and aware of your finances.

Overall, creating a budget as a couple can help you achieve your financial goals and strengthen your relationship by working towards a common financial future.

Assess Your Financial Situation As A Couple

Assessing your financial situation as a couple is the first step towards creating a successful budget. This step involves determining your combined income and expenses, identifying your shared financial goals, and discussing your individual financial habits and attitudes towards money.

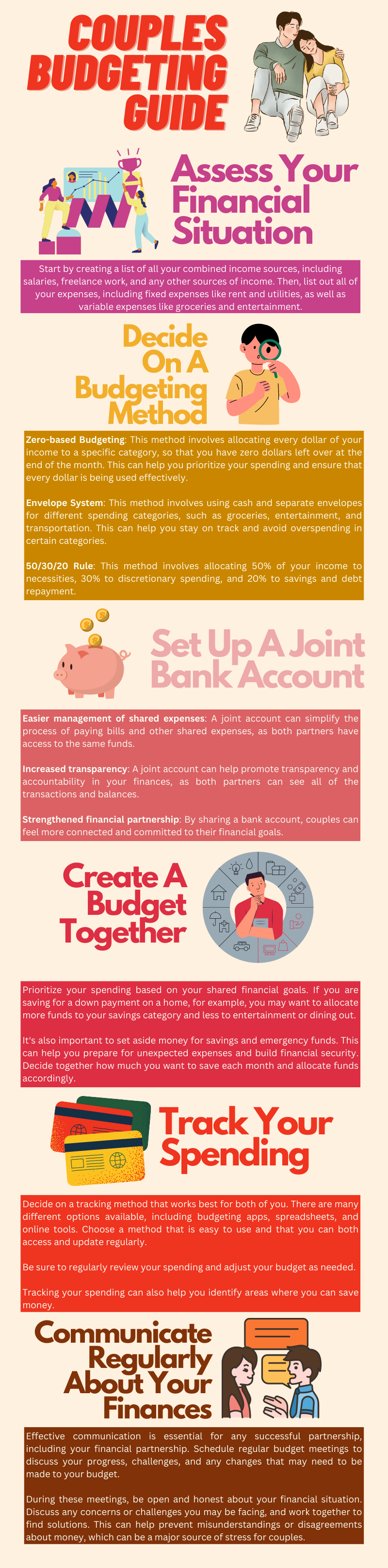

Start by creating a list of all your combined income sources, including salaries, freelance work, and any other sources of income. Then, list out all of your expenses, including fixed expenses like rent and utilities, as well as variable expenses like groceries and entertainment.

Next, identify your shared financial goals. Discuss what you want to achieve together, such as saving for a down payment on a home, paying off debt, or taking a vacation. Make sure you both agree on these goals and prioritize them together.

It’s also important to discuss your individual financial habits and attitudes towards money. Everyone has different experiences and beliefs about money, which can affect how they approach budgeting. Talk about your spending habits, savings goals, and any financial concerns you may have. Be honest and open with each other, and work together to find a budgeting method that suits your individual needs and preferences.

By assessing your financial situation together, you can create a budget that reflects your shared goals and priorities. This can help you both stay on track and achieve financial success as a couple.

Decide On A Budgeting Method That Works For Both Of You

After assessing your financial situation as a couple, the next step is to decide on a budgeting method that works for both of you. There are several different budgeting methods, each with their own advantages and disadvantages.

Some popular budgeting methods include:

- Zero-based budgeting: This method involves allocating every dollar of your income to a specific category, so that you have zero dollars left over at the end of the month. This can help you prioritize your spending and ensure that every dollar is being used effectively.

- Envelope system: This method involves using cash and separate envelopes for different spending categories, such as groceries, entertainment, and transportation. This can help you stay on track and avoid overspending in certain categories.

- 50/30/20 rule: This method involves allocating 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment.

It’s important to discuss these different methods with your partner and agree on one that suits your lifestyle and financial goals. Consider your spending habits, income, and financial goals when choosing a budgeting method.

The key to successful budgeting is to stick to your plan and adjust as needed. Choose a method that you both feel comfortable with and that will help you achieve your shared financial goals. By working together and staying accountable, you can create a budget that works for both of you.

Set Up A Joint Bank Account (If Necessary)

Setting up a joint bank account can be a helpful tool for couples who want to manage their finances together. However, it’s important to discuss the pros and cons of having a joint account before making any decisions.

Some of the benefits of a joint account include:

- Easier management of shared expenses: A joint account can simplify the process of paying bills and other shared expenses, as both partners have access to the same funds.

- Increased transparency: A joint account can help promote transparency and accountability in your finances, as both partners can see all of the transactions and balances.

- Strengthened financial partnership: By sharing a bank account, couples can feel more connected and committed to their financial goals.

However, there are also some potential downsides to consider, such as:

- Loss of individual autonomy: A joint account requires both partners to make financial decisions together, which can be difficult if they have different spending habits or priorities.

- Potential for conflicts: If one partner overspends or makes a financial mistake, it can affect both partners and potentially lead to conflicts.

If you do decide to set up a joint account, make sure to discuss the logistics together. Decide how much money each partner will contribute, how you will handle shared expenses, and what the rules will be around withdrawals and spending. Make sure to choose a bank and account that suits your needs and offers the features you want, such as online banking and mobile apps.

By discussing the pros and cons of having a joint account and setting clear guidelines, couples can make informed decisions about their finances and strengthen their financial partnership.

Create A Budget Together

Creating a budget together is an important step towards achieving your financial goals as a couple. Start by determining your fixed and variable expenses. Fixed expenses include things like rent, utilities, and loan payments, while variable expenses include things like groceries, entertainment, and clothing.

Next, allocate funds for different categories based on your income and expenses. You can use the budgeting method you chose in step 2 to help you do this. For example, if you are using the zero-based budgeting method, you would allocate every dollar of your income to a specific category, such as housing, transportation, food, and entertainment.

Be sure to prioritize your spending based on your shared financial goals. If you are saving for a down payment on a home, for example, you may want to allocate more funds to your savings category and less to entertainment or dining out.

It’s also important to set aside money for savings and emergency funds. This can help you prepare for unexpected expenses and build financial security. Decide together how much you want to save each month and allocate funds accordingly.

Finally, make sure to review your budget regularly and adjust as needed. Life circumstances and expenses can change, so it’s important to be flexible and make changes to your budget as necessary.

By creating a budget together, you can ensure that you are both on the same page when it comes to your finances and working towards your shared financial goals.

Get more awesome downloadables right here.

Track Your Spending

Once you have created a budget together, it’s important to track your spending to ensure that you are staying within your budget and making progress towards your financial goals.

Decide on a tracking method that works best for both of you. There are many different options available, including budgeting apps, spreadsheets, and online tools. Choose a method that is easy to use and that you can both access and update regularly.

Be sure to regularly review your spending and adjust your budget as needed. If you notice that you are consistently overspending in a certain category, for example, you may need to reevaluate your budget and make adjustments to that category. This may involve reducing spending in another category or finding ways to increase your income.

Tracking your spending can also help you identify areas where you can save money. For example, if you notice that you are spending a lot on eating out, you may want to start meal planning and cooking at home more often to save money.

It’s important to make tracking your spending a regular habit. Schedule regular check-ins to review your spending and adjust your budget as necessary. This can help you stay on track and make progress towards your financial goals as a couple.

By tracking your spending, you can gain a better understanding of your financial habits and make informed decisions about your budget. This can help you build a stronger financial partnership and achieve your shared financial goals.

Communicate Regularly About Your Finances

Effective communication is essential for any successful partnership, including your financial partnership. Schedule regular budget meetings to discuss your progress, challenges, and any changes that may need to be made to your budget.

During these meetings, be open and honest about your financial situation. Discuss any concerns or challenges you may be facing, and work together to find solutions. This can help prevent misunderstandings or disagreements about money, which can be a major source of stress for couples.

It’s also important to celebrate your financial milestones together. Whether you’ve paid off a debt, reached a savings goal, or stayed within your budget for several months in a row, take time to acknowledge and celebrate your achievements. This can help keep you motivated and positive about your financial future as a couple.

Remember that effective communication involves both talking and listening. Be sure to listen actively and respectfully to your partner’s ideas and concerns, and work together to find solutions that work for both of you.

By communicating regularly about your finances, you can build a strong financial partnership and achieve your shared financial goals.

Conclusion

Creating a budget as a couple can be challenging, but it’s an essential step towards building a strong financial partnership and achieving your shared financial goals. Remember that it takes time, patience, and persistence to develop good financial habits and stick to a budget.

Be prepared for some trial and error as you work to find a budgeting method that works for both of you. It’s important to stay flexible and adjust your budget as needed, while also staying committed to your financial goals as a couple.

Don’t forget the importance of open and honest communication about your finances. Schedule regular budget meetings, listen actively to your partner’s ideas and concerns, and work together to find solutions that work for both of you.

Finally, be sure to celebrate your financial milestones together. Acknowledge and celebrate your achievements along the way, no matter how small they may seem. This can help keep you motivated and positive about your financial future as a couple.

Creating and sticking to a budget as a couple can be challenging, but it’s worth it in the end. By working together and staying committed to your financial goals, you can build a strong financial partnership and achieve the financial future you both desire.