Do you ever worry about what would happen if you suddenly lost your job or faced a major unexpected expense?

It’s a scary thought, but the truth is that emergencies can happen to anyone at any time. That’s why it’s so important to have an emergency fund.

But building an emergency fund can be easier said than done. Maybe you’re not sure how much to save, or you’re struggling to find the extra money to set aside. Perhaps you’re not even sure where to start.

That’s where this blog comes in. This guide is designed to help you navigate the process of creating a financial safety net that can help protect you and your family in case of unexpected events.

I’ll walk you through the steps of setting a goal, creating a budget, and choosing the right account to save your money in. Plus, I’ll give you some tips on how to stay motivated and avoid common pitfalls that can derail your efforts.

If you’re ready to take control of your finances and build a better future for yourself, read on and discover how easy it can be to build an emergency fund. Let’s get started!

Set A Goal

Setting a goal is the first step in building an emergency fund. This is because it gives you a clear target to work towards and helps you stay motivated and focused.

One way to set a goal is to calculate your monthly expenses and aim to save enough to cover three to six months’ worth of living expenses.

However, your goal may vary depending on your personal circumstances. For example, if you’re a freelancer or self-employed, you may want to save even more to account for potential fluctuations in income.

While setting a goal is important, it’s also important to avoid common pitfalls that can hinder your progress. One pitfall to avoid is setting an unrealistic goal that’s too high or too low.

If your goal is too high, you may get discouraged and give up before you’ve made any real progress.

On the other hand, if your goal is too low, you may not have enough saved to cover your expenses in case of an emergency.

To avoid this pitfall, take some time to calculate your expenses and set a realistic goal based on your current financial situation.

Use my How To Budget for Your First Apartment as a guide to create your goals.

Another pitfall to avoid is neglecting to reassess your goal as your financial situation changes.

For example, if you get a higher paying job or pay off a significant debt, you may be able to adjust your goal and save more for your emergency fund.

By regularly reassessing your goal, you can ensure that your emergency fund remains adequate and relevant to your current situation.

Create A Budget

Creating a budget is an essential step in building an emergency fund. A budget helps you track your income and expenses and identify areas where you can cut back on spending to save more money.

To create a budget, start by tracking your income and expenses for a month or two. Then, categorize your expenses and determine where you can make cuts.

Again you can use How To Create An Easy To Follow Budget as a guide to make your budget.

One pitfall to avoid when creating a budget is being too strict or unrealistic. If you set a budget that’s too tight or doesn’t leave any room for fun or leisure activities, you may struggle to stick to it and get discouraged.

It’s important to be honest with yourself about your spending habits and set a budget that’s realistic and sustainable for you.

For example, if you enjoy going out to eat, don’t eliminate it completely from your budget. Instead, look for ways to reduce the frequency or cost of dining out.

Another pitfall to avoid is forgetting to account for irregular or unexpected expenses.

Even with a budget, unexpected expenses can still occur, such as car repairs or medical bills. To avoid this pitfall, make sure to include a category in your budget for miscellaneous expenses or unexpected costs.

By doing so, you can be prepared for these expenses and avoid dipping into your emergency fund unnecessarily.

Choose The Right Account

Choosing the right account to save your emergency fund is the next logical step in the process. The goal is to find an account that offers a good balance of accessibility and interest rates.

A savings account with a high-yield interest rate and no fees is often a good choice, as it allows you to earn interest on your savings while still having easy access to your funds.

However, one pitfall to avoid when choosing an account is being lured in by introductory interest rates or promotional offers that may expire.

Make sure to do your research and choose an account with a competitive interest rate that remains stable over time. You should also be aware of any fees associated with the account, such as monthly maintenance fees or withdrawal fees, and make sure they are minimal or nonexistent.

Another thing to avoid is neglecting to consider the impact of taxes and inflation on your savings.

If the interest rate on your savings account is not keeping up with the rate of inflation, the value of your emergency fund will decrease over time.

Additionally, any interest earned on your savings account is subject to taxes, so it’s important to factor this into your calculations when choosing an account.

Consider consulting with a financial advisor or doing additional research to make an informed decision about which account is right for you.

Make Automatic Transfers

Making automatic transfers is a simple and effective way to build your emergency fund. By setting up automatic transfers, you can ensure that a portion of your income is automatically deposited into your savings account each month, without having to manually transfer the funds yourself.

You can see this guide on How Automating Your Savings Can Change Your Life, to get a better idea while setting up your automatic transfers.

This can help you build your emergency fund gradually over time, without having to think about it too much.

However, one pitfall to avoid when making automatic transfers is forgetting to adjust them as your financial situation changes.

For example, if you get a raise or take on a new expense, you may need to adjust your automatic transfers to reflect your new income and expenses.

Failing to do so can result in you saving too little or too much each month, which can throw off your budget and emergency fund goals.

Another pitfall to avoid is relying solely on automatic transfers to build your emergency fund.

While automatic transfers are a helpful tool, they should not be your only strategy for saving. It’s important to be mindful of your spending habits and actively look for ways to reduce expenses and increase your income.

By doing so, you can free up more money to contribute to your emergency fund and build it up more quickly. Additionally, it’s important to regularly monitor your savings account to ensure that you are on track to meet your goals.

Avoid Dipping Into Emergency Fund

Avoiding dipping into your emergency fund is a crucial aspect of building and maintaining your financial security.

The purpose of an emergency fund is to cover unexpected expenses, such as medical bills or car repairs, without having to rely on credit cards or other forms of debt.

By avoiding dipping into your emergency fund for non-emergency expenses, you can ensure that you have the financial cushion you need in case of a true emergency.

One pitfall to avoid when it comes to dipping into your emergency fund is failing to plan for expected expenses. While an emergency fund is designed to cover unexpected expenses, there are certain expenses that can be anticipated, such as insurance premiums or annual car maintenance.

To avoid dipping into your emergency fund for these expenses, make sure to budget for them separately and save up for them in advance.

Another pitfall to avoid is not replenishing your emergency fund after using it. If you do need to dip into your emergency fund for an unexpected expense, make sure to prioritize replenishing it as soon as possible.

Set a goal to replace the amount you withdrew within a certain timeframe, such as three to six months. By doing so, you can ensure that you are always prepared for the next unexpected expense that may arise.

Re-evaluate Your Emergency Fund Periodically

Re-evaluating your emergency fund periodically is a critical part of maintaining your financial security.

As your income and expenses change over time, it’s important to reassess your emergency fund and ensure that it still aligns with your current needs and goals.

By regularly checking in on your emergency fund, you can ensure that you are prepared for any unexpected expenses that may come your way.

One pitfall to avoid when re-evaluating your emergency fund is neglecting to account for inflation. Over time, the cost of living increases due to inflation, which means that the amount of money you need to cover emergency expenses will also increase.

To account for inflation, it’s important to periodically review your emergency fund and adjust the amount you are saving accordingly.

Another pitfall to avoid is relying on outdated assumptions about your expenses. If you haven’t re-evaluated your emergency fund in a few years, it’s possible that your expenses have changed since you first set it up.

For example, if you have had a child or purchased a new home, your expenses may have increased. Make sure to regularly review your budget and adjust your emergency fund accordingly to ensure that it aligns with your current needs.

Finally, avoid the pitfall of not re-evaluating your emergency fund at all. Make it a habit to review your emergency fund on a regular basis, such as every six months or annually, and make any necessary adjustments to ensure that you are always prepared for the unexpected.

Conclusion

Building an emergency fund is a smart and rewarding financial goal. By setting a savings goal, creating a budget, choosing the right account, making automatic transfers, avoiding dipping into your fund, and periodically re-evaluating your savings plan, you can build a strong and reliable emergency fund.

While there may be pitfalls to avoid along the way, such as neglecting to adjust your automatic transfers or failing to plan for expected expenses, don’t let that deter you from building your emergency fund.

With some careful planning and mindfulness, you can achieve your savings goals and be prepared for any unexpected expenses that may arise.

So, take a deep breath, set your savings goal, and get started on building your emergency fund today!

Remember that financial security and peace of mind are within your reach, and building an emergency fund is an important step towards achieving them. With a bit of effort and dedication, you can create a safety net for yourself and your loved ones that will provide you with peace of mind and financial stability for years to come.

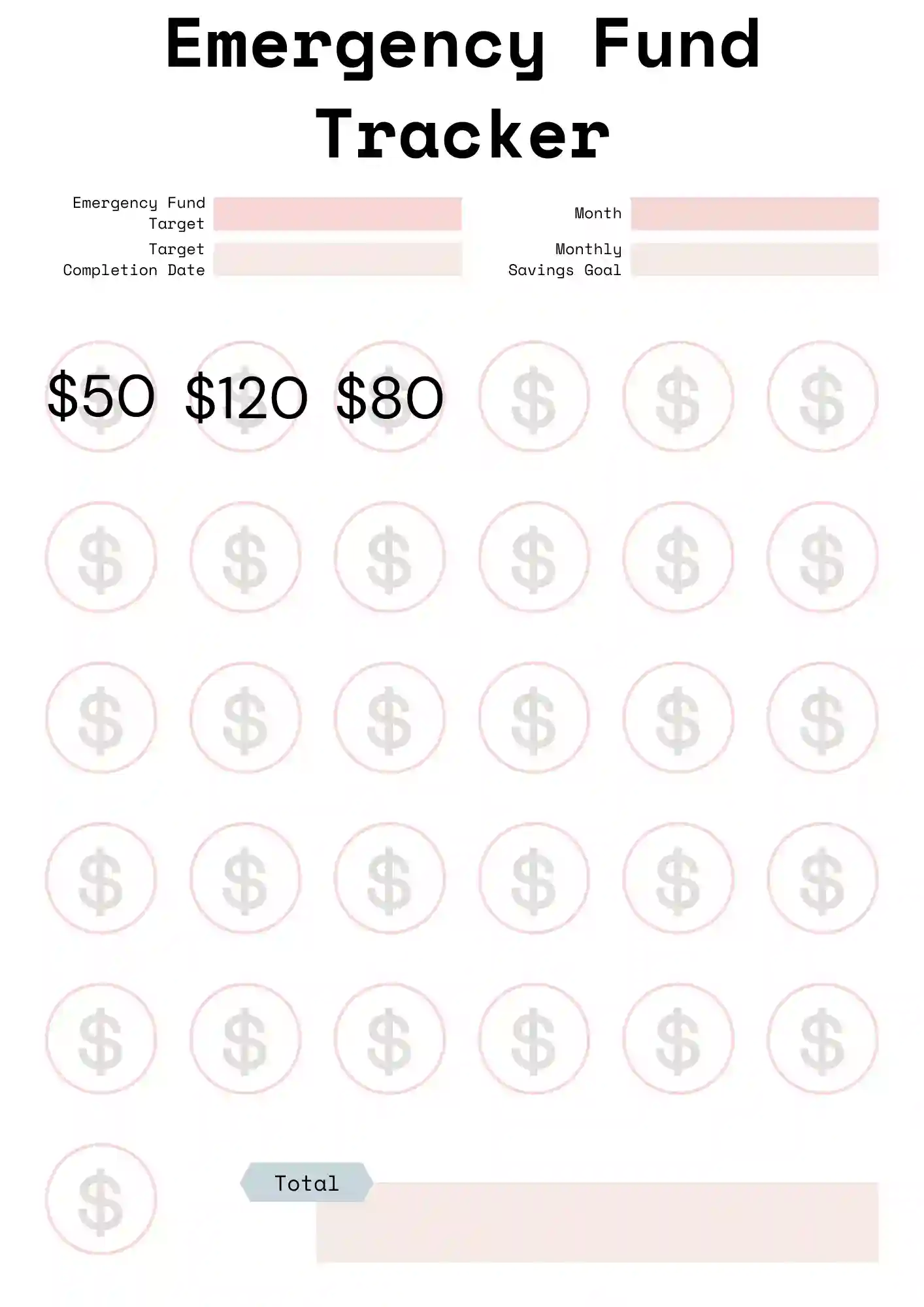

Emergency Fund Tracker