Navigating the world of health insurance can be a daunting task, especially for those who are not familiar with the terminology or the complex policies that come with it. With so many options available, it can be challenging to know where to start or how to choose a plan that fits your needs and budget.

However, understanding health insurance is essential for ensuring that you have access to quality healthcare without facing financial hardship. In this post, we’ll provide you with a comprehensive guide to understanding health insurance, including the basics of how it works, how to choose the right plan for your needs, and tips for making claims and navigating the sometimes complicated world of insurance.

Whether you’re a first-time health insurance buyer or just looking to brush up on your knowledge, this guide is here to help simplify the process and make sure you’re well-informed when it comes to your health coverage. So, let’s dive in and explore the world of health insurance together!

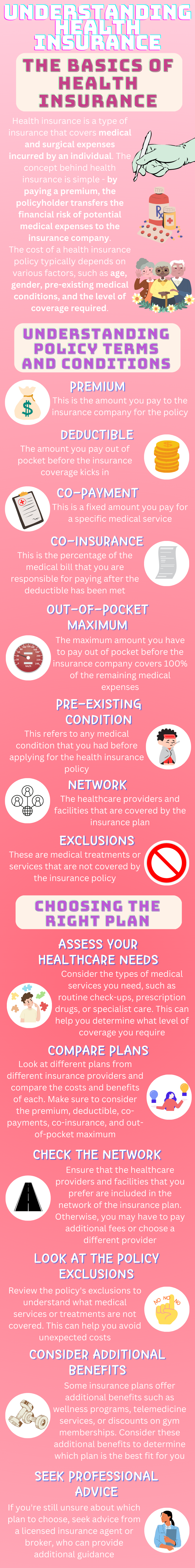

The Basics Of Health Insurance

Health insurance is a type of insurance that covers medical and surgical expenses incurred by an individual. The concept behind health insurance is simple – by paying a premium, the policyholder transfers the financial risk of potential medical expenses to the insurance company. Health insurance is crucial because it protects individuals and families from facing unexpected financial burdens when seeking medical care.

There are several types of health insurance policies available in the market, including individual, family, group, and government-sponsored plans. Each type of policy has its own benefits and limitations, so it’s essential to understand the specifics of the plan you choose.

The cost of a health insurance policy typically depends on various factors, such as age, gender, pre-existing medical conditions, and the level of coverage required. Most health insurance plans require the policyholder to pay a certain amount out of pocket before the insurance coverage kicks in. This is called a deductible, and it varies depending on the policy.

In addition to the deductible, policyholders may also be required to pay co-payments or co-insurance, which are out-of-pocket expenses incurred during medical treatment. These costs can add up quickly, which is why it’s important to carefully consider the level of coverage needed when selecting a health insurance plan.

Understanding the basics of health insurance is essential for ensuring that individuals and families have access to quality healthcare without incurring financial hardship.

Understanding Policy Terms And Conditions

When it comes to health insurance, it’s essential to understand the policy terms and conditions to ensure that you get the most out of your coverage. Here are some key terms to look out for when reviewing your policy:

- Premium – This is the amount you pay to the insurance company for the policy.

- Deductible – The amount you pay out of pocket before the insurance coverage kicks in.

- Co-payment – This is a fixed amount you pay for a specific medical service.

- Co-insurance – This is the percentage of the medical bill that you are responsible for paying after the deductible has been met.

- Out-of-pocket maximum – The maximum amount you have to pay out of pocket before the insurance company covers 100% of the remaining medical expenses.

- Pre-existing condition – This refers to any medical condition that you had before applying for the health insurance policy.

- Network – The healthcare providers and facilities that are covered by the insurance plan.

- Exclusions – These are medical treatments or services that are not covered by the insurance policy.

It’s important to carefully read and understand the terms and conditions of your policy to ensure that you know what is and isn’t covered. If you have any questions or are unsure about anything, don’t hesitate to contact your insurance provider for clarification.

By understanding your policy, you can make informed decisions about your healthcare and avoid any unexpected expenses.

Choosing The Right Plan

Choosing the right health insurance plan can be overwhelming, but it’s important to select a policy that meets your healthcare needs and budget. Here are some tips to help you choose the right plan:

- Assess your healthcare needs – Consider the types of medical services you need, such as routine check-ups, prescription drugs, or specialist care. This can help you determine what level of coverage you require.

- Compare plans – Look at different plans from different insurance providers and compare the costs and benefits of each. Make sure to consider the premium, deductible, co-payments, co-insurance, and out-of-pocket maximum.

- Check the network – Ensure that the healthcare providers and facilities that you prefer are included in the network of the insurance plan. Otherwise, you may have to pay additional fees or choose a different provider.

- Look at the policy exclusions – Review the policy’s exclusions to understand what medical services or treatments are not covered. This can help you avoid unexpected costs.

- Consider additional benefits – Some insurance plans offer additional benefits such as wellness programs, telemedicine services, or discounts on gym memberships. Consider these additional benefits to determine which plan is the best fit for you.

- Seek professional advice – If you’re still unsure about which plan to choose, seek advice from a licensed insurance agent or broker, who can provide additional guidance.

By taking the time to carefully evaluate your healthcare needs and comparing different plans, you can choose the right health insurance policy that provides the coverage you need at a price you can afford.

Making A Claim

Making a claim for your health insurance is a straightforward process, but it’s important to follow the correct steps to ensure that you receive the reimbursement you’re entitled to. Here’s how to make a claim:

- Contact your insurance provider – As soon as you receive medical treatment, contact your insurance provider to inform them of the claim. This will ensure that you receive the proper reimbursement for any eligible expenses.

- Submit documentation – Your insurance provider will typically require documentation, such as receipts or medical bills, to support your claim. Make sure to provide all required documentation promptly and accurately.

- Follow up – If you don’t receive a response from your insurance provider within a reasonable timeframe, follow up with them to ensure that your claim is being processed.

- Keep records – It’s essential to keep copies of all documentation related to your claim, including receipts, medical bills, and correspondence with your insurance provider.

- Appeal if necessary – If your claim is denied, you may have the right to appeal the decision. Review the policy terms and conditions to determine the appeal process and requirements.

Remember, the specific process for making a claim may vary depending on your insurance provider and policy. It’s important to read and understand your policy’s terms and conditions and follow the correct steps to ensure that your claim is processed correctly.

By doing so, you can ensure that you receive the reimbursement you’re entitled to and avoid any unexpected expenses.

Other Tips And Considerations

In addition to understanding the basics of health insurance, there are other tips and considerations to keep in mind to help you make the most out of your coverage. Here are some additional tips:

- Take advantage of preventive care services – Many health insurance plans offer free or low-cost preventive care services, such as annual check-ups and screenings. Take advantage of these services to catch any potential health issues early on and stay healthy.

- Review your coverage regularly – Your healthcare needs may change over time, so it’s important to review your coverage regularly and adjust it as necessary. Make sure that your insurance plan still meets your healthcare needs and budget.

- Be aware of the deadlines – There may be specific deadlines for enrolling in or changing health insurance plans, so make sure to be aware of these deadlines to avoid any penalties or gaps in coverage.

- Understand the impact of lifestyle choices – Certain lifestyle choices, such as smoking or excessive drinking, may impact your health insurance rates or eligibility. Be aware of these factors and take steps to improve your health.

- Consider the financial impact of healthcare expenses – Healthcare expenses can add up quickly, even with insurance coverage. Make sure to budget for any out-of-pocket costs and consider opening a Health Savings Account (HSA) to help offset some of these expenses.

By keeping these tips and considerations in mind, you can make informed decisions about your healthcare and get the most out of your health insurance coverage.