If you’re like many people, you have financial goals, whether it’s saving for a vacation, paying off debt, or building a retirement fund.

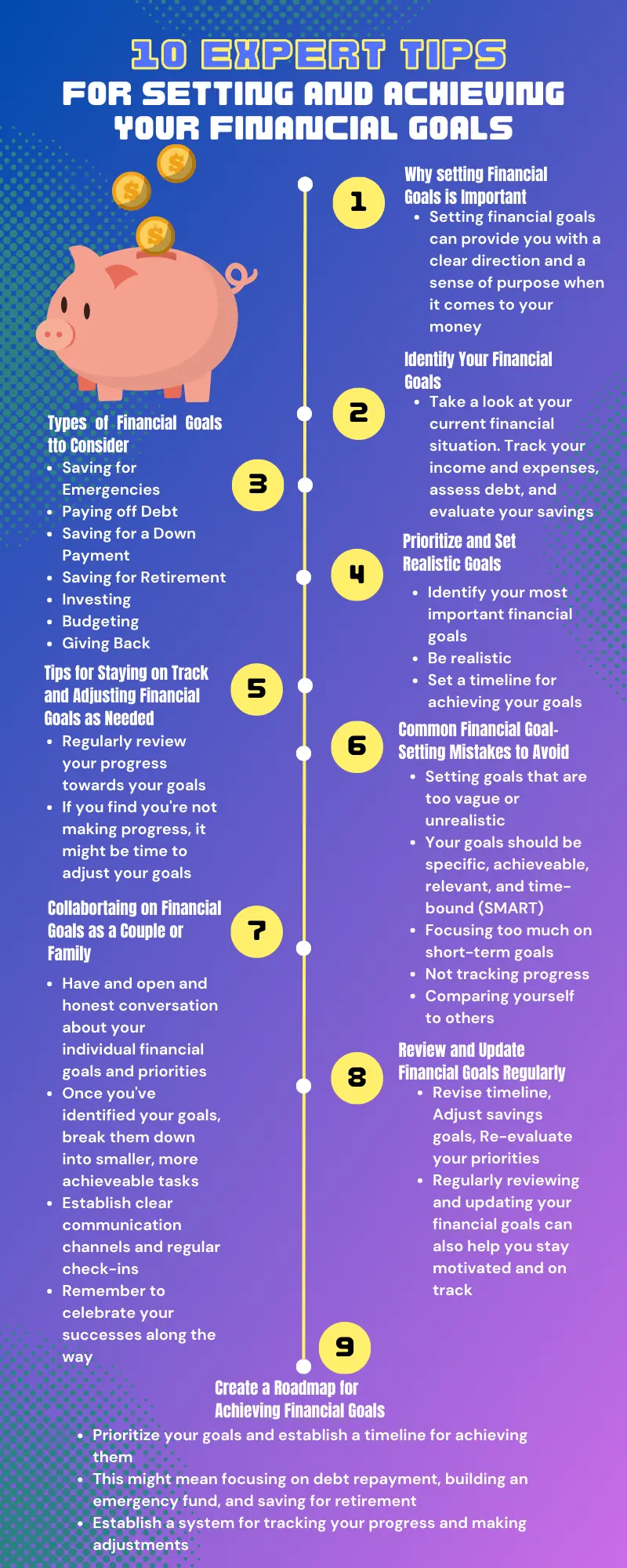

However, setting and achieving those goals can be easier said than done. That’s where our 10 expert tips for setting and achieving your financial goals come in.

In this blog post, I’ll provide you with valuable insights into how to identify your financial goals, prioritize them, and create a roadmap for achieving them.

I’ll offer strategies for staying motivated and on track, as well as tips for using technology to help you achieve your financial goals.

I’ll also cover common mistakes to avoid when setting financial goals, such as setting unrealistic goals or failing to create a plan. I’ll offer advice on how to collaborate with your partner or family on financial goals, and discuss the importance of regularly reviewing and updating your goals as your circumstances change.

My goal is to help you achieve financial success and build a stable financial future. Whether you’re just starting on your financial journey or have been working towards your goals for a while, These expert tips can help you get there faster and with less stress. So let’s dive in!

Why Setting Financial Goals Is Important

Money makes the world go round, or so they say. That’s why setting financial goals is crucial for a secure and stress-free future.

It’s not just about saving up for a fancy new gadget or a dream vacation (although those are great too!), but rather about taking control of your finances and building a stable financial future.

Setting financial goals can provide you with a clear direction and a sense of purpose when it comes to your money. It helps you prioritize your spending, focus on what’s really important, and make smarter financial decisions. It’s also a great way to stay motivated and accountable as you work towards achieving your goals.

Not only that, but setting financial goals can provide you with a sense of security and peace of mind.

Having an emergency fund, for example, can help you weather unexpected financial storms, while saving for retirement can ensure that you can enjoy your golden years without financial stress.

By setting financial goals, you are taking control of your money and your future. It’s a way to build the life you want, free from financial stress and uncertainty. So don’t put it off any longer! Start identifying your financial goals today and take the first step towards financial freedom.

How To Identify Your Financial Goals

When it comes to achieving financial success, the first step is to identify your financial goals. Knowing what you want to achieve with your money will help you create a plan to get there. But how do you identify your financial goals? Here are some tips to get you started.

The first step is to take a look at your current financial situation. This means tracking your income and expenses, assessing your debt, and evaluating your savings. Once you have a clear picture of your finances, you can start thinking about what you want to achieve.

Think about your short-term, medium-term, and long-term financial goals.

Short-term goals might include building an emergency fund or paying off credit card debt. Medium-term goals might include saving for a down payment on a home or paying off a car loan. Long-term goals might include saving for retirement or your children’s education.

It’s also important to consider your values and priorities. What’s important to you? Do you value experiences over possessions? Do you want to prioritize giving back to your community or supporting your family?

By considering your financial situation, your short-term, medium-term, and long-term goals, and your values and priorities, you can start to identify your financial goals.

Remember, your financial goals are unique to you, so don’t compare yourself to others. Focus on what’s important to you, and you’ll be on your way to achieving financial success.

Types Of Financial Goals To Consider

When it comes to setting financial goals, there are many different types to consider. Here are some examples of financial goals you might want to include in your plan.

- Saving for emergencies: An emergency fund can help you weather unexpected financial storms, such as a job loss or a medical emergency.

- Paying off debt: Debt can be a major source of stress, so paying off credit card debt, student loans, or car loans can be a great goal to work towards.

- Saving for a down payment: If you’re planning on buying a home, saving for a down payment is an important goal.

- Saving for retirement: It’s never too early to start saving for retirement. Whether you’re in your 20s or your 50s, putting away money for your golden years is a smart financial goal.

- Investing: Investing can be a great way to build wealth over the long-term.

- Budgeting: Creating a budget can help you prioritize your spending, save money, and achieve your financial goals.

- Giving back: Whether it’s donating to charity or volunteering your time, giving back can be a rewarding financial goal.

These are just a few examples of the types of financial goals you might want to consider. Remember, your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). By setting SMART financial goals, you can create a roadmap to financial success and build a stable financial future.

How To Prioritize And Set Realistic Goals

Setting financial goals is a great way to take control of your money and build a secure financial future. But with so many different goals to consider, how do you prioritize and set realistic goals? Here are some tips to help you get started.

The first step is to identify your most important financial goals. This might be paying off debt, building an emergency fund, or saving for retirement. Once you’ve identified your top priorities, you can start to break them down into smaller, more achievable goals.

When setting goals, it’s important to be realistic. Don’t set goals that are too ambitious or unrealistic. Instead, set goals that are achievable within your current financial situation. This might mean setting smaller goals at first, and then building up to larger ones over time.

It’s also important to set a timeline for achieving your goals. This will help you stay focused and motivated. For example, you might set a goal to pay off your credit card debt within six months, or to save $10,000 for a down payment within two years.

Finally, remember to track your progress and celebrate your successes along the way. This will help you stay motivated and keep you on track towards achieving your goals.

By prioritizing your goals, setting realistic targets, and tracking your progress, you can achieve financial success and build a stable financial future. So go ahead and set those goals, and take the first step towards financial freedom today!

Tips For Staying On Track And Adjusting Financial Goals As Needed

Setting financial goals is an important first step towards achieving financial success, but it’s not enough to simply set them and forget about them.

To truly succeed, it’s important to stay on track and make adjustments as needed. Here are some tips to help you stay on track and adjust your financial goals as needed.

The first step is to regularly review your progress towards your goals. This might mean tracking your spending, reviewing your savings and investments, or checking in on your debt repayment plan. By regularly reviewing your progress, you can catch any issues early and make adjustments as needed.

If you find that you’re not making progress towards your goals as quickly as you’d like, it might be time to adjust your goals. This might mean revising your timeline, breaking your goals down into smaller, more achievable tasks, or reevaluating your priorities.

It’s also important to be flexible and willing to adjust your goals as your financial situation changes.

For example, if you get a raise at work, you might be able to save more for retirement or pay off debt more quickly. On the other hand, if you experience a financial setback, you might need to adjust your goals to accommodate your new circumstances.

Achieving financial success is a journey, and it’s okay to adjust your goals as needed. By staying on track, being flexible, and regularly reviewing your progress, you can achieve your financial goals and build a stable financial future.

Common Financial Goal-Setting Mistakes To Avoid

When it comes to setting financial goals, it’s easy to make mistakes that can derail your progress and leave you feeling frustrated. Here are some common financial goal-setting mistakes to avoid.

The first mistake is setting goals that are too vague or unrealistic. To be successful, your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). This means breaking your goals down into smaller, more achievable tasks and setting a timeline for achieving them.

Another common mistake is focusing too much on short-term goals and neglecting long-term planning. While it’s important to pay off debt and build an emergency fund, it’s also important to plan for the future by saving for retirement and investing for the long-term.

Not tracking your progress is also a common mistake. By tracking your spending, savings, and investments, you can catch any issues early and make adjustments as needed.

Finally, comparing yourself to others can be a big mistake. Everyone’s financial situation is different, and what works for one person may not work for another. Instead, focus on your own goals and celebrate your own successes, no matter how small they may seem.

By avoiding these common mistakes and staying focused on your own financial goals, you can achieve financial success and build a secure financial future. So go ahead and set those goals, stay on track, and don’t forget to celebrate your successes along the way!

Collaborating On Financial Goals As A Couple Or Family

Collaborating on financial goals as a couple or family can be challenging, but it’s an important part of building a secure financial future together. Here are some tips to help you work together to achieve your financial goals.

The first step is to have an open and honest conversation about your individual financial goals and priorities. This might mean discussing your debt repayment plans, your savings goals, or your retirement plans. By understanding each other’s goals and priorities, you can work together to create a shared vision for your financial future.

Once you’ve identified your shared financial goals, it’s important to break them down into smaller, more achievable tasks. This might mean creating a budget, tracking your spending, or setting a timeline for achieving your goals.

It’s also important to establish clear communication channels and regular check-ins. This might mean setting a weekly or monthly meeting to review your progress towards your goals and make any necessary adjustments.

Finally, remember to celebrate your successes along the way. By working together to achieve your financial goals, you can build a stronger relationship and a more secure financial future for your family.

Collaborating on financial goals can be challenging, but with open communication, clear goals, and regular check-ins, you can work together to achieve financial success and build a brighter financial future for your family.

Importance Of Reviewing And Updating Financial Goals Regularly

Setting financial goals is an important step towards achieving financial success, but it’s not enough to simply set them and forget about them. To truly achieve your financial goals, it’s important to review and update them regularly.

Regularly reviewing your financial goals allows you to track your progress and make any necessary adjustments. This might mean revising your timeline, adjusting your savings goals, or reevaluating your priorities.

Updating your financial goals also allows you to adapt to changes in your financial situation. For example, if you receive a raise or bonus at work, you might be able to increase your retirement contributions or pay off debt more quickly. On the other hand, if you experience a financial setback, you might need to adjust your goals to accommodate your new circumstances.

Regularly reviewing and updating your financial goals can also help you stay motivated and on track. By breaking your goals down into smaller, more achievable tasks, you can celebrate your successes along the way and stay motivated to continue working towards your goals.

Achieving financial success is a journey, and it’s important to regularly review and update your goals to stay on track. By staying flexible, adapting to changes, and celebrating your successes along the way, you can achieve your financial goals and build a brighter financial future for yourself and your family.

Creating A Roadmap For Achieving Financial Goals

Creating a roadmap for achieving your financial goals is an important step towards financial success. Here are some tips to help you create a roadmap that works for you.

The first step is to identify your financial goals and break them down into smaller, more achievable tasks. This might mean creating a budget, tracking your spending, or setting a timeline for achieving your goals.

Next, prioritize your goals and establish a timeline for achieving them. This might mean focusing on debt repayment first, then building an emergency fund, and finally saving for retirement.

Once you’ve established your priorities and timeline, it’s important to create a plan for achieving each goal. This might mean increasing your income, reducing your expenses, or investing in the stock market.

It’s also important to establish a system for tracking your progress and making adjustments as needed. This might mean setting regular check-ins to review your progress and adjust your goals as necessary.

By creating a roadmap for achieving your financial goals and staying focused on your priorities, you can achieve financial success and build a brighter financial future for yourself and your family.